Insights into global media and device usage in 44 markets, and how consumer habits shifted towards mobile after the 2020 pandemic lockdown.

Southeast Asia

Southeast Asia

The Southeast Asia coverage in the Global Media Intelligence Report includes poll results from Indonesia, Malaysia, Singapore, the Philippines, Thailand, and Vietnam. Click the links to see each country’s or territory’s charts for the following metrics:

The Southeast Asia coverage in the Global Media Intelligence Report includes poll results from Indonesia, Malaysia, Singapore, the Philippines, Thailand, and Vietnam. Click the links to see each country’s or territory’s charts for the following metrics:

- Device Ownership

- Smartphone and Tablet Owners

- Smart TV Owners

- Average Time Spent With Media

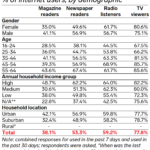

- Traditional Media Users

- TV Viewers

- Video-on-Demand (VOD) Viewers

- Social Media/Messaging Users

- Digital Audio Listeners

- Voice Assistant/Search Users

Key Takeaways

Key Takeaways

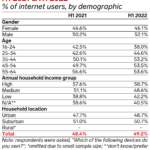

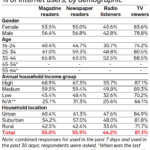

- In Southeast Asia, the adoption of digital services and devices is generally tied to affluence and urban areas, which is reflected in GWI’s data set for the region.

- Income diversity in the region is evident in ownership rates of many digital devices. With the exception of smartphones, which have a lower price point and are ubiquitous across the region, ownership of nice-to-have digital devices like smart TVs, tablets, and smart wristbands is lowest in Southeast Asia compared with all other regions tracked by GWI.

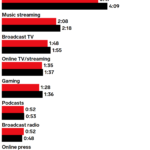

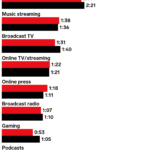

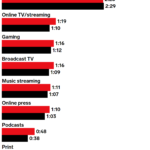

- Time spent with media in the region strongly favors mobile. It now far outpaces time spent with PCs and tablets—3 hours, 8 minutes (3:08) daily versus 4:31 on mobile. The mobile-first appetite for media will likely remain strong as 5G mobile networks continue to roll out in the region.

- While consumption of traditional media like broadcast TV and terrestrial radio is in decline worldwide, some countries buck this trend. A few of them are in Southeast Asia—notably, Malaysia for radio and Vietnam for TV.

Southeast Asia in Perspective

Leading Ahead

Leading Ahead

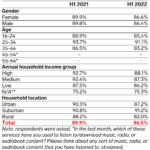

Streaming of both audio and video in Southeast Asia is very high compared with most regions.

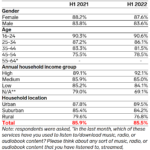

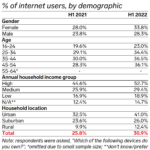

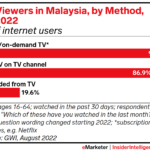

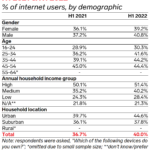

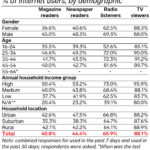

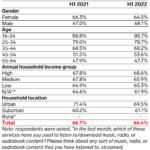

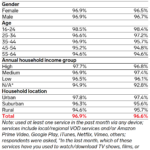

- VOD viewing was reported by 96.0% of respondents in the region in H1 2022. That penetration rate trails only Latin America’s globally. In the Asia-Pacific region, the rate was 86.7%. Consistency of adoption was evident across gender, age, income, and living location. Every age cohort surveyed showed penetration rates above 90%.

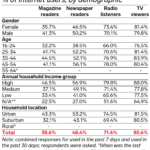

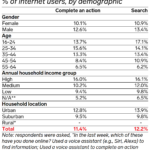

- Music/audio streaming penetration was 82.1% in H1 2022. Unlike VOD viewing, uptake of audio streaming was influenced by age, income, and living location.

- These listeners skewed younger, wealthy, and urban. Some 88.2% of the 16-to-24 age bracket streamed audio versus just 64.6% of the 55-to-64 age group; 81.3% of low-income respondents streamed audio versus 85.5% of those with high incomes; and 76.6% of rural respondents did so versus 85.0% of their urban counterparts.

Trailing Behind

Trailing Behind

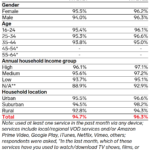

The income divide in Southeast Asia is most evident in ownership rates of digital devices.

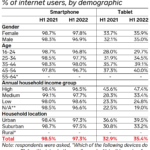

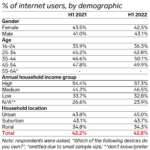

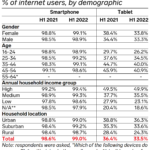

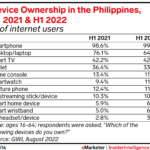

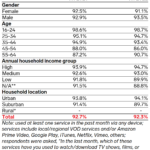

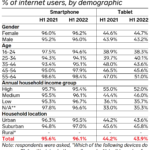

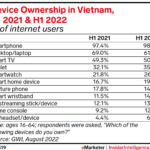

- Smartphone adoption is ubiquitous (97.1%) across the region, as price points are low. However, ownership of more expensive and less-essential devices differs dramatically between low- and high-income internet users.

- Ownership rates for PCs in Southeast Asia were 47.0% for respondents with low incomes and 71.7% for those with high incomes in H1 2022. Smart TV ownership was 24.2% and 54.3% for the respective groups. Ownership of game consoles was 7.9% for those with low incomes, compared with 25.5% for those with high incomes. Smartwatch ownership was 10.9% for the former and 32.8% for the latter. The rates for virtual reality (VR) headsets and devices sat at 4.0% and 9.4%, respectively.

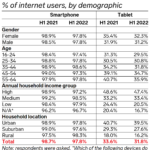

- Tablet ownership in Southeast Asia was just 25.8%, the lowest of any region in the world. It’s clear that income level has the largest bearing on tablet ownership in Southeast Asia, as just 16.0% of low-income respondents owned one, compared with 41.7% of those with high incomes. Rural adoption is also very low, at just 11.0%.

- Smart wristband ownership was just 9.9% in Southeast Asia, the lowest of any region. The Middle East and Africa was closest in this metric, at 10.6%.

- Smartphone adoption is ubiquitous (97.1%) across the region, as price points are low. However, ownership of more expensive and less-essential devices differs dramatically between low- and high-income internet users.

- Ownership rates for PCs in Southeast Asia were 47.0% for respondents with low incomes and 71.7% for those with high incomes in H1 2022. Smart TV ownership was 24.2% and 54.3% for the respective groups. Ownership of game consoles was 7.9% for those with low incomes, compared with 25.5% for those with high incomes. Smartwatch ownership was 10.9% for the former and 32.8% for the latter. The rates for virtual reality (VR) headsets and devices sat at 4.0% and 9.4%, respectively.

- Tablet ownership in Southeast Asia was just 25.8%, the lowest of any region in the world. It’s clear that income level has the largest bearing on tablet ownership in Southeast Asia, as just 16.0% of low-income respondents owned one, compared with 41.7% of those with high incomes. Rural adoption is also very low, at just 11.0%.

Streaming of both audio and video in Southeast Asia is very high compared with most regions.

- VOD viewing was reported by 96.0% of respondents in the region in H1 2022. That penetration rate trails only Latin America’s globally. In the Asia-Pacific region, the rate was 86.7%. Consistency of adoption was evident across gender, age, income, and living location. Every age cohort surveyed showed penetration rates above 90%.

- Music/audio streaming penetration was 82.1% in H1 2022. Unlike VOD viewing, uptake of audio streaming was influenced by age, income, and living location.

- These listeners skewed younger, wealthy, and urban. Some 88.2% of the 16-to-24 age bracket streamed audio versus just 64.6% of the 55-to-64 age group; 81.3% of low-income respondents streamed audio versus 85.5% of those with high incomes; and 76.6% of rural respondents did so versus 85.0% of their urban counterparts.

Media Consumption by Country

Indonesia

Indonesia

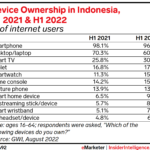

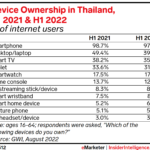

- Smart devices in Indonesia experienced an adoption growth spurt over the past three years. Since H1 2019, smart TV penetration has climbed from 21.6% to 30.9%; smartwatches jumped from 9.7% to 15.4%; smart home products went from 6.2% to 9.3%; and smart wristbands increased from 3.9% to 7.4% of internet users in H1 2022.

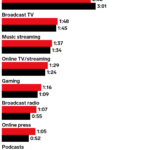

- The average daily time spent with PCs and tablets in Indonesia dropped from 3:44 in H1 2019 to 3:01 this year. Mobile time increased by 7 minutes over that same period to 4:44 per day, which means mobile minutes didn’t directly displace time spent on nonmobile devices.

Malaysia

Malaysia

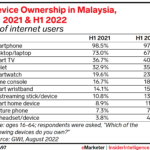

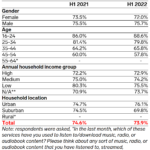

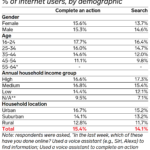

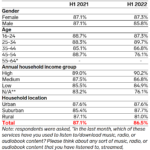

- Radio listenership in Malaysia, with a penetration rate of 71.6% in Q1 2022, far outpaced the regional average of 48.6%. The 45-to-54 age group led the way with 78.0% penetration. Time spent with broadcast radio jumped to 1:07 daily in H1 2022, up from 55 minutes in H1 2021.

Philippines

Philippines

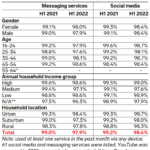

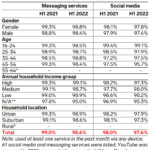

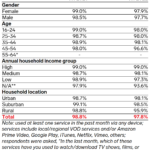

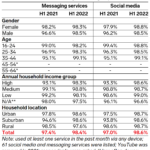

- The Philippines takes the No. 1 spot for time spent with mobile devices among all countries tracked by GWI, at 5:39 daily. The penetration rate of smartphones in H1 2022 was 99.0% in the country, higher than all regional averages tracked by GWI. Mobile connection speeds in the Philippines continue to improve, which will only serve to entrench the Filipino appetite for mobile media consumption.

- A significant contributor to mobile time in the Philippines is the use of social media and messaging services—here, too, the country leads all others GWI tracks in time spent, at 3:47 daily. Penetration of social media is also extremely high, at 99.8% in H1 2022.

Singapore

Singapore

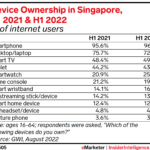

- Singapore is widely regarded as one of the wealthiest countries in the world, and its affluence is evident in its much higher ownership rates of nice-to-have digital products compared with the rest of Southeast Asia.

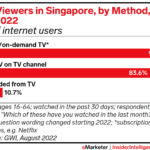

- Smart TV penetration in H1 2022 was 49.2%, much higher than the 37.0% average across the region; high-income respondents saw a penetration rate of 58.7%. Tablet adoption was 43.9%, well above the regional average of 25.8%; among high-income respondents, it was 52.0%. Game console ownership was 19.4% in Singapore, compared with 14.5% for the region and 23.2% for the country’s high-income respondents.

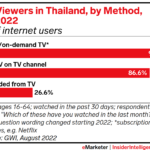

Thailand

Thailand

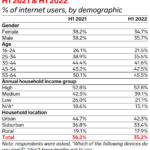

- PC penetration has dropped significantly in Thailand, from 49.4% in H1 2021 to 39.9% in H1 2022. Adoption among female respondents (36.6%) was much lower than among their male counterparts (43.2%). Those ages 25 to 34 showed the lowest rate of adoption, at 34.5%. What’s more, daily time spent on PCs and tablets was down 38 minutes to 3:17, a drop of 16.2%.

Vietnam

Vietnam

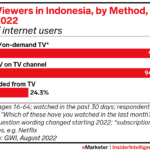

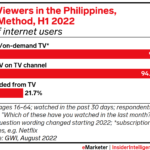

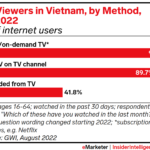

- Traditional TV viewership in Vietnam increased in Q1 2022 to 81.1%, more than 1 percentage point higher than the regional average. Most other countries in the region saw a decline in TV viewership. (Indonesia, like Vietnam, saw a gain in penetration.) Even among rural respondents, TV penetration climbed, from 68.3% in Q1 2021 to 71.7% during the same quarter this year. Average daily time spent increased to 1:16 in H1 2022, up 7 minutes from H1 2021.

Key Takeaways

Key Takeaways