Home is healthcare’s new frontier. Retailers and insurers are at the consumers’ front doors. RPMs and at-home diagnostic tests boost these efforts.

Insurers and retailers are now buying home health companies to expand into in-home care. Remote patient monitoring (RPM) and at-home diagnostic tests are helping to boost these efforts. Up to $265 billion in care services for traditional Medicare and Medicare Advantage (MA) beneficiaries could migrate from traditional facilities to the home by 2025, per McKinsey & Company. Expect more big brands to move in.

Retailers and Insurers Are Racing to Consumers’ Front Doors.

Home is healthcare’s new frontier.

Home is healthcare’s new frontier.

Providing in-home care can reduce costs related to emergency room visits, decrease hospital readmissions, and even speed recovery time. Over the past year, big companies—including retailers like Amazon—have spent billions to stake a claim in the home healthcare market.

Baby boomers looking to “age in place” will be prime candidates for in-home healthcare.

Baby boomers looking to “age in place” will be prime candidates for in-home healthcare.

By 2030, all of the nearly 70 million boomers (now 58 to 76 years old) will be 65 or older, with the oldest close to 85. Most will be using some form of Medicare for their health coverage.

In-home healthcare brands are poised for expansion.

In-home healthcare brands are poised for expansion.

Thanks to their preexisting connections with MA patients:

![]() One Medical (which offers 24/7 remote care and was acquired by Amazon) reported that capitated contracts in MA plans made up 50% of its Q3 2022 net revenues, even though MA members comprise only 5% of its total membership.

One Medical (which offers 24/7 remote care and was acquired by Amazon) reported that capitated contracts in MA plans made up 50% of its Q3 2022 net revenues, even though MA members comprise only 5% of its total membership.

![]() CVS Health/Aetna, Humana, and UnitedHealth Group—three recent acquirers of in-home healthcare brands—collectively manage 16 million patients who receive MA benefits, per analysis by the Kaiser Family Foundation. That accounts for more than half of all MA enrollment in 2022.

CVS Health/Aetna, Humana, and UnitedHealth Group—three recent acquirers of in-home healthcare brands—collectively manage 16 million patients who receive MA benefits, per analysis by the Kaiser Family Foundation. That accounts for more than half of all MA enrollment in 2022.

![]() And in October 2022, the Centers for Medicare & Medicaid Services (CMS) estimated a 0.7% increase in Medicare payments to home health companies in 2023—versus the proposed 4.4% cut.

And in October 2022, the Centers for Medicare & Medicaid Services (CMS) estimated a 0.7% increase in Medicare payments to home health companies in 2023—versus the proposed 4.4% cut.

Prediction

Prediction

Expect more acquisitions and consolidation around home healthcare in 2023. Amazon could add a senior-focused insurtech to maximize revenues following its official acquisition of One Medical. Meanwhile, CVS Health will continue searching for a scalable primary care platform to complement Signify Health.

RPM Is Still Surging

Demand for convenience and distanced care continues.

Demand for convenience and distanced care continues.

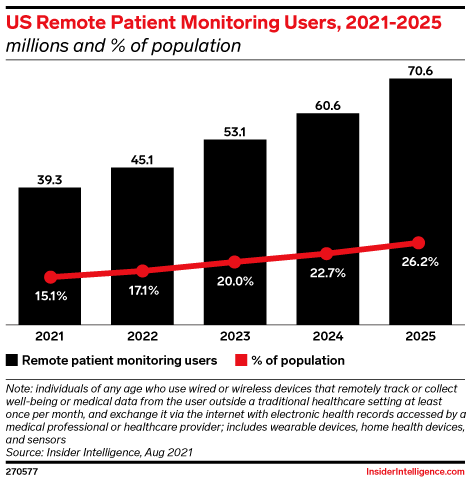

RPM adoption will only increase post-pandemic. We estimate there will be 70.6 million RPM users in the US by 2025, up 56.5% from 2022. In three years, more than one-quarter of the US population will be regularly using a device that remotely tracks or collects their well-being or medical data for their doctors to assess.

The RPM space in 2023 will be rife with players, from providers to retailers:

The RPM space in 2023 will be rife with players, from providers to retailers:

![]() Some 57% of provider organizations already use RPM to monitor patients’ vital signs at home, according to a January 2022 survey conducted by Sage Growth Partners on behalf of Rhythm.

Some 57% of provider organizations already use RPM to monitor patients’ vital signs at home, according to a January 2022 survey conducted by Sage Growth Partners on behalf of Rhythm.

![]() Over 75% of US medical practices will be using RPM by January 2024.

Over 75% of US medical practices will be using RPM by January 2024.

![]() Best Buy recently doubled down on its long-term RPM bet. The retailer is piloting a partnership between its Geek Squad and Geisinger Health to assist with the setup of patients’ RPM devices at home and educate them on the technology, per Modern Healthcare.

Best Buy recently doubled down on its long-term RPM bet. The retailer is piloting a partnership between its Geek Squad and Geisinger Health to assist with the setup of patients’ RPM devices at home and educate them on the technology, per Modern Healthcare.

Predictions

Predictions

Demand for RPM will increase, but a lack of a broadband connection will still be an issue for many patients, especially those who are elderly and/or live in rural areas.

Healthcare staffing challenges could make it difficult to implement RPM tools in regular patient care—which takes at least three employees to manage for the majority of medical practices, per Rhythm.

At-Home Tests—Beyond Those for COVID-19—Take Off

The do-it-yourself healthcare market is booming.

The do-it-yourself healthcare market is booming.

While sales of COVID-19 tests are waning, manufacturers and providers are rolling out other types of at-home tests, including those for sexually transmitted diseases—now considered an “out-of-control” situation in the US.

The global home diagnostics market was estimated at $5.42 billion in 2021 and is expected to reach $8.15 billion by 2030.

The global home diagnostics market was estimated at $5.42 billion in 2021 and is expected to reach $8.15 billion by 2030.

![]() B2B testing giants Labcorp and Quest Diagnostics each offer a suite of at-home tests consumers can order without a prescription.

B2B testing giants Labcorp and Quest Diagnostics each offer a suite of at-home tests consumers can order without a prescription.

![]() CVS Health recently partnered with ixlayer, maker of at-home tests, to offer at-home sample collection kits under its retail brand name.

CVS Health recently partnered with ixlayer, maker of at-home tests, to offer at-home sample collection kits under its retail brand name.

![]() Direct-to-consumer (D2C) testing startups like Everlywell, LetsGetChecked, Kindbody, and Ro are jostling for consumers’ attention on social media.

Direct-to-consumer (D2C) testing startups like Everlywell, LetsGetChecked, Kindbody, and Ro are jostling for consumers’ attention on social media.

Predictions

Predictions

Next year will bring a raft of mergers and acquisitions, particularly among the D2C brands that are concentrated on specific areas—like sexual health. Telehealth companies will be a major buyer segment.

Approval by the Food and Drug Administration (FDA) will be required. The FDA gave emergency use approval to several brands of at-home COVID-19 tests, which helped boost usage at key points in the pandemic. Consumers will want to see the FDA’s stamp of approval on more tests before they buy.