US financial institutions (FIs) are struggling to maintain consumer trust in an increasingly volatile market environment. That trust is even more precarious in digital channels, where there’s less human touch and greater fraud risk. This study from eMarketer reveals the weakest points in FIs’ trust and steps they can take to build trust amid crisis.

Key Takeaways

Key Takeaways

Traditional FIs will face tougher competition for customer loyalty going forward: Consumers no longer consider their current primary bank or credit union as the provider they’d trust most to supply them with banking services. PayPal now holds the top spot.

- The three most trusted FIs in our study were all incumbents, beating out neobanks. This is the first year we ranked incumbent banks and neobanks alongside each other.

- Capital One took first place overall, scoring 86.1 points out of a possible 100. It triumphed in the Security, Privacy, Reputation, and Reliability categories, while also scoring well in Feature Breadth and Ease of Use. Chase was runner-up with 85.5 points.

- Consumers are increasingly comfortable with nontraditional service providers. A smaller proportion of consumers now consider incumbents and neobanks the providers they’d trust most to provide banking services, while trust in PayPal and Apple increased considerably.

FIs That Step Up in Today’s Crisis Will Reap Trust in the Long Term

Trust is FIs’ most valuable commodity. Without it, the premise of their business collapses. And it’s even more essential in digital banking, which is low touch and anonymous. Consumers who have high trust in their FIs show more digital engagement, satisfaction, and loyalty.

But a cycle of instability means building and keeping customer trust has never been harder. Political turmoil has been followed by a pandemic, an economic downturn, rising geopolitical tension, and an onslaught on fundamental rights. The result is rising anxiety about what author Shoshana Zuboff calls “surveillance capitalism” and distrust of authority: Only 43% of Americans now trust their government, down 10 percentage points from 2017, per research conducted by Edelman in November 2021.

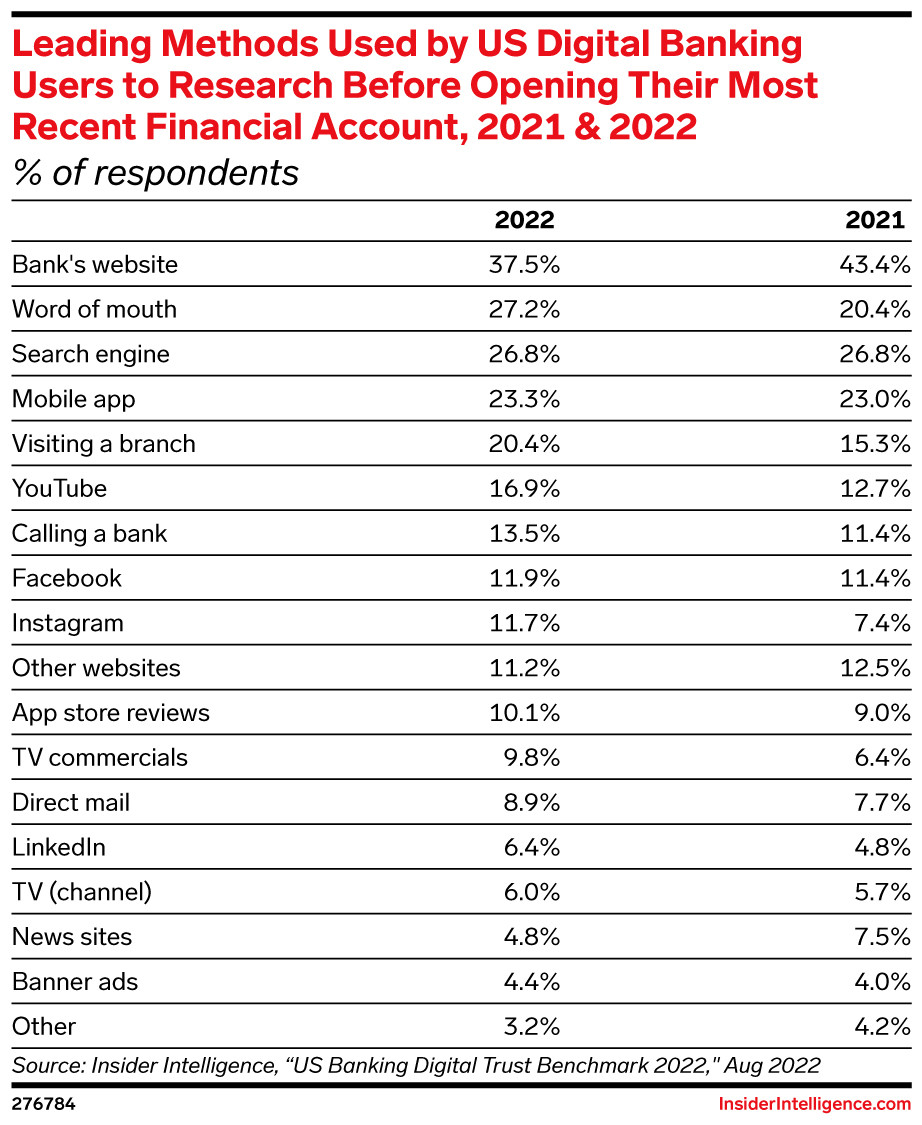

FIs are feeling the effects of diminished faith in institutions. When asked in 2021 which companies they would trust most to provide financial services, our survey respondents gave first prize to incumbents. This year, the old guard slipped 6.1 percentage points to second place, trailing PayPal. And the proportion of respondents calling neobanks their most trusted providers dropped 2 percentage points.

FIs that prove themselves trustworthy in this time of crisis can emerge with stronger-than-ever customer relationships and bottom lines. This report shows what factors most determine consumers’ level of trust in FIs and provides data-driven recommendations on how to bolster that trust going forward.

This year, the Banking Digital Trust Benchmark provides a comprehensive overview of how institutions of all types measure up regarding trust: For the first time, it ranks the four largest neobanks by user numbers alongside the 10 largest banks by asset size, as these digital players embed themselves in mainstream financial services.

Methodology at a Glance

Methodology at a Glance

Digital trust is shaped primarily by six factors: Security, Privacy, Reputation, Reliability, Feature Breadth, and Ease of Use. We used a two-step approach to benchmark FIs’ digital trust ratings across these factors:

![]() Respondents gauged each factor’s influence on overall digital trust via an online survey. We fielded this survey of 1,961 US digital banking users between May and June 2022 to determine the importance of each factor in promoting a feeling of trust when using digital banking.

Respondents gauged each factor’s influence on overall digital trust via an online survey. We fielded this survey of 1,961 US digital banking users between May and June 2022 to determine the importance of each factor in promoting a feeling of trust when using digital banking.

![]() Respondents rated their FIs within each category, generating each FI’s overall score. We asked how each factor described FIs that respondents had accounts with, on a 7-point scale from “strongly disagree” (1 point) to “strongly agree” (7 points). Mean values for each factor were converted to points and then weighted by the category value to obtain the overall FI scores. All FI ratings obtained from the survey were weighted by primary bank status, age, and gender to calculate bank category and overall scores and determine rankings. For general consumer preference data, we did not weight respondents.

Respondents rated their FIs within each category, generating each FI’s overall score. We asked how each factor described FIs that respondents had accounts with, on a 7-point scale from “strongly disagree” (1 point) to “strongly agree” (7 points). Mean values for each factor were converted to points and then weighted by the category value to obtain the overall FI scores. All FI ratings obtained from the survey were weighted by primary bank status, age, and gender to calculate bank category and overall scores and determine rankings. For general consumer preference data, we did not weight respondents.

Leaders in Digital Trust

Capital One

Capital One

Capital One secured the highest overall score for the second year running, placing in the top three across all six digital trust categories. At 86.1 points, the incumbent far surpassed the study’s average total score of 83.5. It swept to first place in the top-valued Security, Privacy, Reputation, and Reliability categories.

As of June, Capital One’s app was the most downloaded banking app in the US, per Apptopia—highlighting the correlation between mobile satisfaction and trust for FIs.

Chase

Chase

Chase won second place overall with far above-average scores in several key categories. It came second in Security and third in Reputation, while also securing high ranks in the less critical Reliability and Feature Breadth categories. This balanced out its tepid fifth-place finish in Privacy.

Citibank

Citibank

Citibank rounded out the top three, ranking highly in two of the most critical categories. It won third place in Security and second in Reputation, which buoyed the bank despite average performance across the remaining categories.

No. 1: Security

Category Value: 24.2% of total points

Security’s already critical importance will rise as digitization accelerates, diplomacy deteriorates, and regulatory scrutiny intensifies. The shift to digital channels for banks and customers poses clear cybersecurity risks due to a broadened attack surface. Russia’s invasion of Ukraine has prompted Congress to launch a new cybersecurity act, while watchdogs may mandate banks to report breaches and ransomware payments. But banks shouldn’t wait for such orders to bolster their defenses, as consumers aren’t lenient about failures: 41% of customers in India blame banks rather than hackers when breaches occur, per a LocalCircles February 2022 survey.

Capital One took first place in Security, rising from second place in 2021. Consumers appear reassured by the bank’s lack of security incidents since its large-scale data breach in 2019, and by its dedicated page with running updates on the matter. They are rewarding Capital One for a perceived improvement in and openness about security protocols. In our study, primary customers gave the bank a higher score (6.2) than secondary customers (6.0).

Here are the top three features that would make respondents feel most secure:

![]() Guaranteed reimbursement for fraudulent transactions. Peer-to-peer (P2P) payment fraud is thriving on platforms like Venmo and Zelle, but Regulation E only entitles consumers to bank reimbursement for unauthorized transactions, not scams where users initiate transfers themselves.

Guaranteed reimbursement for fraudulent transactions. Peer-to-peer (P2P) payment fraud is thriving on platforms like Venmo and Zelle, but Regulation E only entitles consumers to bank reimbursement for unauthorized transactions, not scams where users initiate transfers themselves.

To build trust, FIs should pledge to reimburse customers in the event of fraud. This could even help them preempt legal trouble: TD Bank, Bank of America, and Capital One have recently been hit with class action lawsuits over fraud reimbursement.

![]() Real-time alerts for sensitive transactions. FIs can build trust by specifically supporting alerts for transactions that are time sensitive or involve large sums. For instance, they can send customers alerts for high-value transactions: If a customer did not authorize the transaction, this could help them quickly flag the fraud and dispute the charge with the bank, avoiding further damage.

Real-time alerts for sensitive transactions. FIs can build trust by specifically supporting alerts for transactions that are time sensitive or involve large sums. For instance, they can send customers alerts for high-value transactions: If a customer did not authorize the transaction, this could help them quickly flag the fraud and dispute the charge with the bank, avoiding further damage.

![]() Monitoring for stolen information online. More than ever, personally identifiable information (PII) is available for criminals to misappropriate, as a record number of consumers shop digitally: 76.7% of US consumers will make an online purchase in 2022, per our June 2022 forecast.

Monitoring for stolen information online. More than ever, personally identifiable information (PII) is available for criminals to misappropriate, as a record number of consumers shop digitally: 76.7% of US consumers will make an online purchase in 2022, per our June 2022 forecast.

To stay ahead of data thieves, FIs can deploy software that flags attempted fraud and identity theft based on behavioral context clues. For example, NetGuardians’ AI-powered system triggers include unfamiliar browsers and unexpected screen resolution on login devices.

No. 2: Privacy

Category Value: 22.3% of total points

Consumers are increasingly aware of the digital footprint they leave, and are seeking a balance between personalization and privacy. Nearly 90% of consumers said they want their bank to proactively offer personalized financial advice, but less than 30% said they currently receive it, according to a 2022 survey by telecom and cloud communications provider Sinch. However, this appetite for relevancy is counterbalanced by ever-greater unease over having customer data tracked and harvested: Almost half (48%) of US consumers said they had switched providers because of their data sharing policies and practices, per Cisco’s 2019 Consumer Privacy Survey.

Capital One took first place in Security, rising from second place in 2021. Consumers appear reassured by the bank’s lack of security incidents since its large-scale data breach in 2019, and by its dedicated page with running updates on the matter. They are rewarding Capital One for a perceived improvement in and openness about security protocols. In our study, primary customers gave the bank a higher score (6.2) than secondary customers (6.0).

Capital One eked out a win in Privacy, moving up from last year’s third place. It scored well above the category’s 83.6-point average, with 85.9 points. The bank provides an easy-to-understand privacy policy, outlining how it collects customer data, what it does with the data, and what data rights exist under US law.

Here’s a look at what types of personal information customers are—and aren’t—comfortable with FIs using for personalization purposes:

Location data. Customers don’t think the personalization payoff is worth sharing this granular data with their FIs—even if the location data is gathered while digital banking is actively being used. In fact, 60% of consumers have turned off location sharing on mobile devices to protect their privacy, according to a February 2022 Tinuiti survey.

Companies that differentiate themselves by championing consumer privacy, like DuckDuckGo and Apple, garner more positive brand perception, per a February 2022 article in the Harvard Business Review. FIs can reap similar benefits by allowing customers to disable location data collection—and advertising that fact in promotional materials.

Financial and lifestyle data. Seventy percent of consumers would rather receive less relevant offers than have their behavior tracked, according to Tinuiti. This could stem from banks’ precedent of using such data to discriminate against account applicants.

To respect consumers’ privacy without losing out on engagement due to irrelevant product recommendations, FIs can tap into bank-driven solutions such as the recently launched Authentify, which grants consumers greater control over their financial data.

Direct communication data. In good news for banks, customers are largely comfortable with FIs using data points like call center interactions, customer service chat logs, transactional information, and in-house products used.

As third-party data streams dry up, FIs should find ways to maximize the collection and analysis of zero- and first-party data. One emerging avenue for doing so is launching super apps to keep customers within a proprietary product ecosystem.

No. 3: Reputation

Category Value: 15.6% of total points

Consumers are holding FIs to ever-higher ethical standards—and the rise of value-driven younger customers will keep ratcheting up the pressure. As of 2019 (the most recently available data), consumers who chose their bank according to its ethics or purpose accounted for $300 billion in banking revenues, per a 2021 McKinsey & Company article—and idealistic younger consumers constituted the biggest chunk of this market. Regulators are now codifying these changing standards into law, cracking down on discriminatory bank practices, and even threatening to revoke the licenses of banks that repeatedly act unethically.

Capital One took a narrow victory over Citibank, improving on its 2021 third-place finish. Capital One’s success is owed largely to its primary customers, who awarded it a mean Reputation score of 6.2, versus 6.0 from nonprimary customers. The bank also emphasizes the link between financial and mental well-being on its home page: Under a “how can we help?” menu, options include “sleep better at night” and “help me feel secure,” which likely resonate with customers in this precarious socioeconomic climate.

Customers are particularly skeptical of FIs’ efforts in three purpose-driven areas:

![]() Environmental impact. Over 50% of US consumers “never” or “only sometimes” believe banks’ claims of being environmentally friendly, according to GreenPrint’s March 2021 Business of Sustainability Index. This is unsurprising: Banks invested $742 billion in fossil fuel companies in 2021, with Chase, Wells Fargo, Citigroup, and Bank of America among the biggest offenders globally, per the 2022 Banking on Climate Chaos report.

Environmental impact. Over 50% of US consumers “never” or “only sometimes” believe banks’ claims of being environmentally friendly, according to GreenPrint’s March 2021 Business of Sustainability Index. This is unsurprising: Banks invested $742 billion in fossil fuel companies in 2021, with Chase, Wells Fargo, Citigroup, and Bank of America among the biggest offenders globally, per the 2022 Banking on Climate Chaos report.

To repair trust, FIs should measure their environmental progress against quantifiable metrics and cut through the fluff of marketing campaigns. They can first evaluate their sustainability progress against the maturity model provided in Insider Intelligence’s Sustainable Banking report.

![]() Societal impact. Recent reports of discrimination at FIs are fueling consumer skepticism: Wells Fargo approved only 47% of Black homeowners’ mortgage refinancing applications in 2020, versus 72% for white applicants, according to a March 2022 Bloomberg analysis.

Societal impact. Recent reports of discrimination at FIs are fueling consumer skepticism: Wells Fargo approved only 47% of Black homeowners’ mortgage refinancing applications in 2020, versus 72% for white applicants, according to a March 2022 Bloomberg analysis.

FIs accused of perpetuating social biases should demonstrate willing cooperation with investigators to find improvements—Wells Fargo, by contrast, refused to share details on its refinancing algorithms with Bloomberg.

![]() Community philanthropic efforts. This should ring alarm bells for large banks, many of which spend billions of dollars annually on philanthropic community-focused initiatives. FIs should get ahead of changes in the updated Community Reinvestment Act (CRA) by scaling down their projects to have more of an immediate community impact. Such efforts will also be felt more directly by local customers, helping to build trust.

Community philanthropic efforts. This should ring alarm bells for large banks, many of which spend billions of dollars annually on philanthropic community-focused initiatives. FIs should get ahead of changes in the updated Community Reinvestment Act (CRA) by scaling down their projects to have more of an immediate community impact. Such efforts will also be felt more directly by local customers, helping to build trust.

No. 4: Reliability

Category Value: 13.8% of total points

Digital is now consumers’ primary mode of banking, making the reliability of digital channels foundational in forming trust. We forecast that 81.1% of US consumers will use digital banking by 2024—up from 67.3% in 2019. Accommodating this volume of digital users will be challenging—something Truist experienced firsthand after money disappeared from some customers’ accounts during the 2019 merging of its SunTrust and BB&T platforms.

Capital One kept its Reliability crown from 2021. FIs’ performance was relatively weak in this category, with the 82.8-point average score being the study’s second lowest—but Capital One overachieved with a score of 85.1. The bank continues to benefit from its 2020 migration to the Amazon Web Services (AWS) cloud, which enabled it to cut down on disaster recovery times and transaction errors. For instance, if systems fail in one geography, it can maintain service continuity by booting up from another region.

Customers may avoid digital banking features due to reliability fears—here are three areas where FIs should focus improvements:

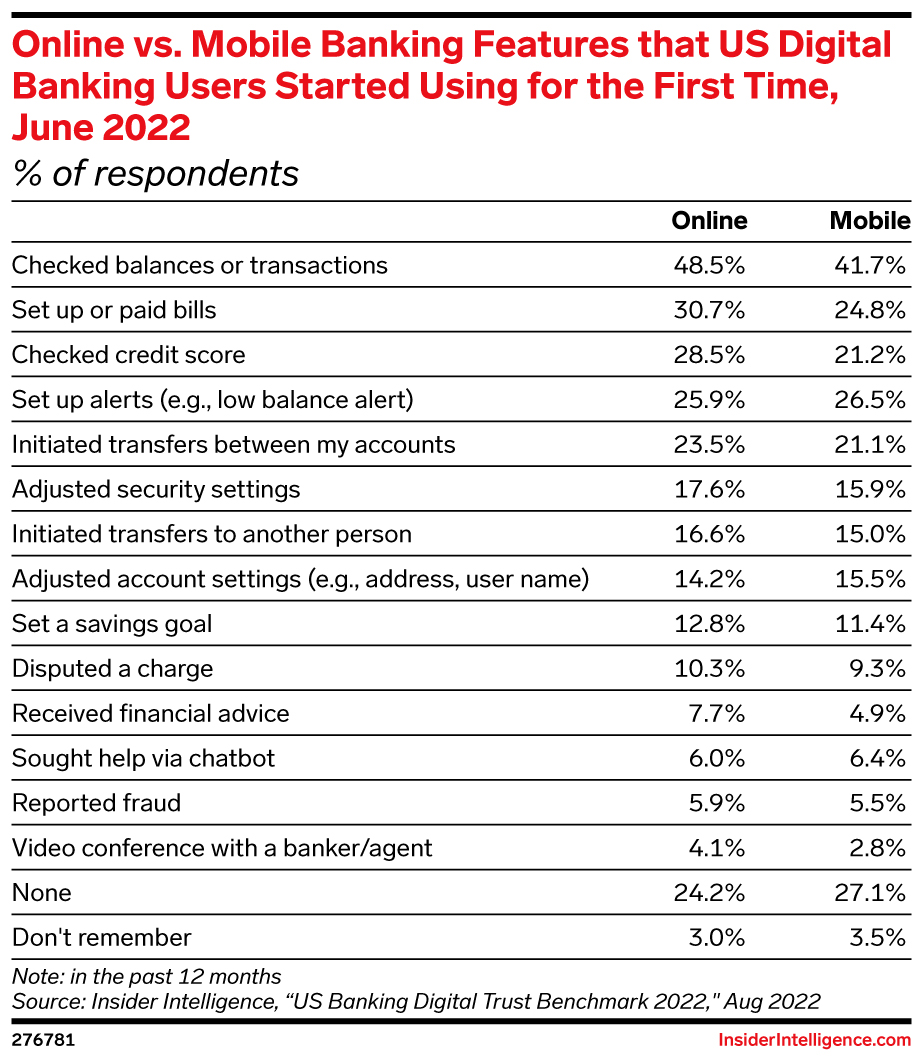

![]() Digital bill payments. Paying a bill was the most avoided feature on average across online and mobile banking users. This spells trouble for FIs on the engagement front, since many users are new to the feature: “Setting up or paying bills” was the second most cited feature that consumers in our study used for the first time in the past year.

Digital bill payments. Paying a bill was the most avoided feature on average across online and mobile banking users. This spells trouble for FIs on the engagement front, since many users are new to the feature: “Setting up or paying bills” was the second most cited feature that consumers in our study used for the first time in the past year.

To allay customer concerns about mishaps, FIs should put systems in place that immediately notify customers of failed payments.

![]() Money transfer between personal accounts. Across digital banking users, 12.1% on average had avoided transferring money between their own accounts. But this feature is increasingly important to maintaining trust as recession looms, with a quarter of consumers planning to tap their savings to pay bills or loans, according to a May 2022 TransUnion survey. FIs must proactively supply customers with clear instructions on using money transfers to provide reassurance and reduce customer errors.

Money transfer between personal accounts. Across digital banking users, 12.1% on average had avoided transferring money between their own accounts. But this feature is increasingly important to maintaining trust as recession looms, with a quarter of consumers planning to tap their savings to pay bills or loans, according to a May 2022 TransUnion survey. FIs must proactively supply customers with clear instructions on using money transfers to provide reassurance and reduce customer errors.

![]() P2P transfers. Transferring money to another person was the third most avoided feature on average across digital banking users. This could be especially detrimental to financially strapped users: Nearly a quarter of consumers unable to pay bills or loans planned to borrow money from friends or family, per the TransUnion survey.

P2P transfers. Transferring money to another person was the third most avoided feature on average across digital banking users. This could be especially detrimental to financially strapped users: Nearly a quarter of consumers unable to pay bills or loans planned to borrow money from friends or family, per the TransUnion survey.

To avoid alienating users, FIs should preemptively educate customers about the most common P2P transfer errors and provide tips on avoiding and rectifying them.

No. 5: Feature Breadth

Category Value: 12.2% of total points

Having a full range of digital banking features has become table stakes for consumers, so FIs that fall short in this category will be considered slacking. The percentage of respondents calling this category “extremely important” declined from 40.3% in 2021 to 36.8% in 2022, underscoring the fact that customers now take a comprehensive digital feature suite for granted.

Chase triumphed in the overall weakest category. The 81.8-point average score was the lowest of all six categories; Chase beat it by a sound 3.7 points. The bank’s broad array of features similarly secured its crown in our 2021 US Mobile Banking Emerging Features Benchmark, which measures how banks’ mobile offerings align with consumer demand. Despite shareholder scrutiny of its astronomical tech spend, customers’ appreciation of Chase’s comprehensive feature suite helps justify the outlays.

Here are three areas where customers are particularly dissatisfied with feature breadth:

![]() Human support. For the second year, this was the feature the greatest proportion of respondents found insufficient on average (13.4%). This reflects banks’ overall dearth of support: In our inaugural US Account Opening Benchmark, only one of 14 FIs offered live agent chat.

Human support. For the second year, this was the feature the greatest proportion of respondents found insufficient on average (13.4%). This reflects banks’ overall dearth of support: In our inaugural US Account Opening Benchmark, only one of 14 FIs offered live agent chat.

FIs can win both trust and personalization points by introducing more options for human help. Agents can help FIs gather more data to deepen insights while also creating a more intimate customer experience. And they can ward off regulatory ire: When the Consumer Financial Protection Bureau fined Bank of America in July for faulty unemployment benefits fraud detection, it underscored that the bank did not employ enough customer service representatives to handle the case volume.

![]() Security features. Dissatisfaction went up from 10.5% of respondents on average in 2021 to 11.3% this year—posing a perception problem for banks as cybersecurity risks and fraud proliferate.

Security features. Dissatisfaction went up from 10.5% of respondents on average in 2021 to 11.3% this year—posing a perception problem for banks as cybersecurity risks and fraud proliferate.

FIs should, at a minimum, offer the most valued features covered in our Security section to maintain a trust baseline and avoid denting confidence in this tense period. They should also prioritize features—such as guaranteed reimbursement for customer-initiated transaction fraud—that exceed legal regulations and standard industry practices.

![]() Personal financial management tools. On average, 11.3% of respondents were dissatisfied with FIs’ offerings, despite many of these tools being low-hanging fruit for FIs. For example, credit score tools are available as plug-ins from credit reporting agencies, but only three of the top 10 banks in our 2021 US Mobile Banking Emerging Features Benchmark offered them.

Personal financial management tools. On average, 11.3% of respondents were dissatisfied with FIs’ offerings, despite many of these tools being low-hanging fruit for FIs. For example, credit score tools are available as plug-ins from credit reporting agencies, but only three of the top 10 banks in our 2021 US Mobile Banking Emerging Features Benchmark offered them.

As recession storm clouds gather, FIs should provide features that help users stretch their funds. To get the highest trust-building return, these features should lift much of the money management burden off customers.

No. 6: Ease of Use

Category Value: 11.9% of total points

Streamlined digital banking experiences are no longer a differentiator when it comes to building trust—they are a staple in maintaining it. The proportion of respondents calling Ease of Use “extremely important” dropped 7.3 percentage points this year. Digital banking’s omnipresence means streamlined websites and applications are table stakes—but subpar experiences can still damage consumer trust.

TD Bank came out on top in this strong category for FIs. It beat the study’s best average of 84.2 points by a comfortable margin, with its primary customers awarding it a higher category score than nonprimary customers. This bears out in TD’s high app ratings: 4.3 out of 5 on Google Play, and 4.8 out of 5 in the Apple App Store.

Here’s where customers found FIs’ ease of use most lacking:

![]() Language. On average, only 43.5% of respondents agreed that “I understand all the words/terminology that the bank uses,” making it the least agreed-with statement for the second year running. This is unsurprising, given their dense industry jargon: The average readability of FIs’ websites is below that of materials like academic literature on technical subjects, per language analysis platform VisibleThread’s 2020 Asset Management Clarity Report.

Language. On average, only 43.5% of respondents agreed that “I understand all the words/terminology that the bank uses,” making it the least agreed-with statement for the second year running. This is unsurprising, given their dense industry jargon: The average readability of FIs’ websites is below that of materials like academic literature on technical subjects, per language analysis platform VisibleThread’s 2020 Asset Management Clarity Report.

FIs can make low-cost fixes to their communications to augment customer trust. VisibleThread recommends targeting language at an eighth-grade or below readership level and keeping sentences at 20 words or under.

![]() Loading speeds. On average, fewer customers agreed that FIs’ website loading speeds are fast this year (44.9%) than in 2021 (45.5%). This could expose FIs to engagement drop-offs: Users tend to lose focus if an app takes more than a second to load, per Google data cited by the Financial Times in August 2021.

Loading speeds. On average, fewer customers agreed that FIs’ website loading speeds are fast this year (44.9%) than in 2021 (45.5%). This could expose FIs to engagement drop-offs: Users tend to lose focus if an app takes more than a second to load, per Google data cited by the Financial Times in August 2021.

FIs should test their website and mobile app loading speeds across different browsers and devices using tools like BrowserStack’s SpeedLab to ensure they fall within the gold standard of 0–4 seconds. To improve results, they can deploy content delivery networks, reduce file sizes, and strip pop-ups and animations to lighten page weights.

![]() Accessibility. On average, only 45.1% of customers agreed that FI website text is large enough to read. This could dent trust, especially among baby boomers, who place greater importance on Ease of Use than any other generation we surveyed.

Accessibility. On average, only 45.1% of customers agreed that FI website text is large enough to read. This could dent trust, especially among baby boomers, who place greater importance on Ease of Use than any other generation we surveyed.

Ignoring the needs of older cohorts will cost FIs: US baby boomers’ wealth hit $71 trillion in January 2022, a 28% surge since the start of the pandemic, per Federal Reserve data. Low-cost, simple fixes can facilitate navigation and help maintain goodwill, like font size toggles for small screens.

Recommendations

Redirect trust-building funds into features customers find most valuable, such as guaranteed fraud reimbursement and the option to disable the gathering of GPS data when mobile banking is not being used.

Identify weak points in brand perception to brainstorm remedies. For instance, only 17.7% of respondents “strongly agree” that their bank’s marketing and messaging accurately reflect its corporate values.

Use the study’s crosstabs to gain insights into customer segments. FIs can see how trust perceptions differ across generation, gender, household income, race, and region to better tailor their trust-building efforts.

Methodology

What is this study, and which banks are included?

This study ranks the 10 largest consumer-facing US banks by asset size and the four largest neobanks by user count, based on six factors that affect the level of trust US digital banking users feel when using digital banking: Security, Privacy, Reputation, Reliability, Feature Breadth, and Ease of Use. Our sample captured customers of three additional banks; this additional data was excluded from scoring and ranking calculations for accuracy.

How were the six categories of digital trust selected?

The categories were carried over from our 2020 survey. We fielded a validation survey between January 24 and January 30, 2020, that asked respondents (n=830) from Insider Intelligence’s proprietary panel to choose among multiple factors that could influence their trust in digital banking. Respondents in this panel tended to be younger, male, affluent, North American, and identified as early tech adopters. The most popular answers became the categories of the annual study: Security, Privacy, Reputation, Reliability, Feature Breadth, and Ease of Use.

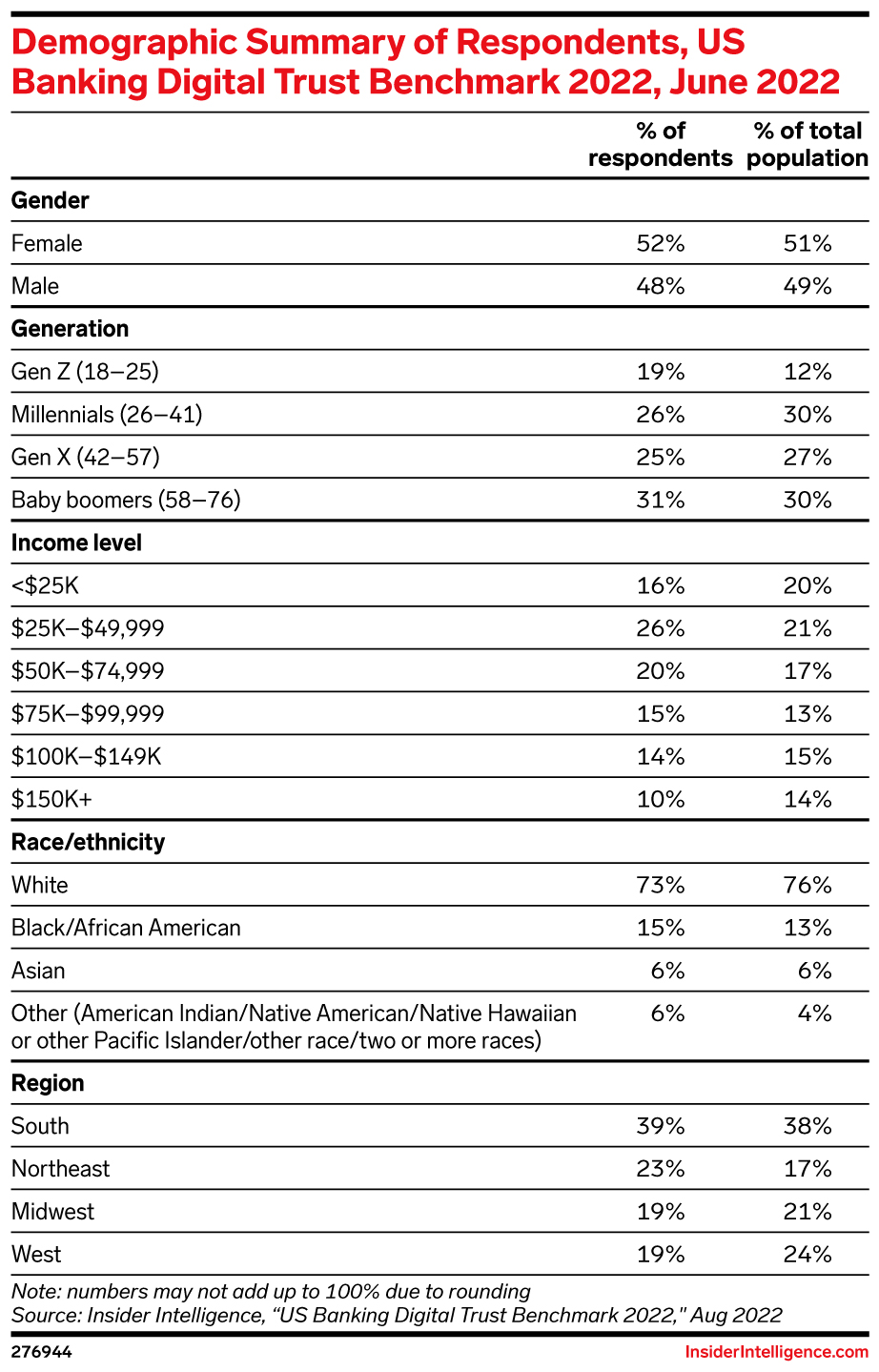

How was the survey conducted? Who answered the survey?

We fielded an online survey of 1,961 US digital banking users between May 16 and June 13, 2022, using a third-party sample provider. Respondents were users of online or mobile banking at one or more of the 17 banks and/or neobanks in the study. The sample was selected to align with the US population on the criteria of age (among those ages 18–76), gender, income, race/ethnicity, and region. To see how our sample compares with the broader US population (measured against US Census data), please refer to the demographics chart below.

How did you rank each bank?

We used a system where the maximum number of points is 100, which a bank could achieve if all respondents who are its customers gave the bank the maximum rating within each category of the report. Here’s more detail:

- Category weights. Respondents were asked to assess how important the six categories were in determining the level of trust they feel when using digital banking, on a scale from “not at all important” to “extremely important.” Weights for each category were generated based on the percentage of respondents answering “extremely important.” To ensure all category weights added up to 100 points, we used a multiplier of 32.99. For example, 73.4% of respondents called Security “extremely important.” Therefore, the weighted maximum point value of the category is 73.4% (0.734) multiplied by 32.99, equaling 24.21 points.

- Banks’ category scores. Customers of a given bank were asked about their level of agreement with a series of statements about their bank relating to each category. Respondents answered on a 7-point scale ranging from “strongly disagree” (1 point) to “strongly agree” (7 points). The mean number value of survey responses on the 7-point scale by all the customers of a given bank determined its score within the category. For example, if the mean customer level of agreement for a given bank on Privacy is 6.5, we calculate the bank’s score within the category by dividing 6.5 over 7 (the highest possible ranking), equaling 93 points.

- Banks’ customer segment weights. Individual bank scores were weighted according to primary bank status, nonprimary bank status, age, and gender to ensure that differences in each bank’s customer makeup year over year (which represented statistical noise) did not influence scores or rankings. The age and gender weights used are based on Insider Intelligence’s US digital banking users forecast.

- Banks’ overall scores. We applied the category weights to the category scores to obtain each bank’s score. Only consumer perceptions factor into rankings and scores.