Inflation is forcing consumers to rethink shopping. A positive retail experience builds more lasting and predictable buying habits.

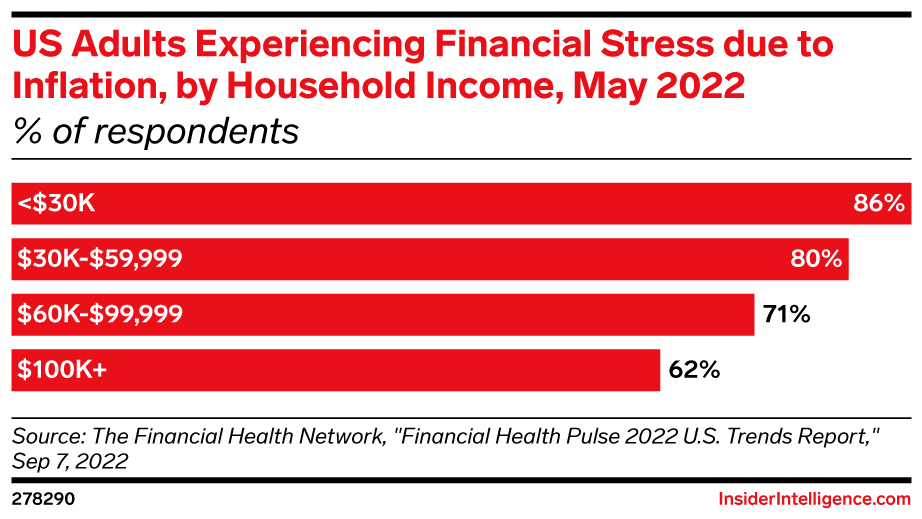

The dynamic economic condition is exacerbating the disparity between those who can afford to pay more for items and those who cannot. While consumers were happy to dip into their savings in 2021, economic and geopolitical uncertainty in 2022 could lead shoppers to take a more cautious approach toward spending.

Here’s a look at the impact of consumer and retailer response to inflation:

Inflation is still consumers’ top concern in 2023

After a year of coping with rising prices and economic uncertainty, most consumers are looking to keep a lid on expenses and avoid unnecessary spending in 2023.

- Roughly eight in 10 US adults think 2023 will be a year of economic difficulty, according to a Gallup poll. Almost two-thirds (65%) think prices will rise at a high rate this year.

- Forty-three percent of US consumers cited inflation’s impact on everyday expenses and saving as their top financial concern for 2023, according to Fidelity Investments’ Financial Resolutions Survey.

- More than half—56%—of US households plan to save money in 2023, per Kroger’s 84.51°. Financial goals were the second-most popular New Year’s resolution for 2023, per Numerator, up 6% compared with last year, as consumers try to reduce expenses and cut back on non-essential purchases.

A Challenging Year

A Challenging Year

While consumers were largely able to keep pace with inflation in 2022, 2023 could be a different story as persistent inflation takes its toll on spending power.

- The personal saving rate (the percentage of disposable income that people save) fell sharply in 2022 to its lowest level since 2005, a sign of consumers’ diminishing ability to swallow price increases.

- Stretched budgets will allow even less wiggle room for big-ticket items like electronics and jewelry, both of which saw sales fall during the 2022 holiday season, according to Mastercard SpendingPulse data. And any excess funds are more likely to be funneled to services like travel and dining out over items like televisions and furniture.

How Retailers Can Respond

How Retailers Can Respond

The most pressing question for retailers now is how to encourage value-conscious shoppers to spend at a time when they feel increasingly stretched thin.

- With 71% of households looking for sales and coupons to combat rising grocery store prices, per 84.51°, retailers may have no choice but to offer more sales or deeper discounts to keep shoppers from switching to cheaper competitors or stopping shopping altogether.

- More retailers are also turning to gift cards as a way to encourage spending, said Stacey Widlitz, president of SW Retail Advisors. For example, Anthropologie is offering $50 in credit to shoppers who spend $200 or more online—but the money can only be used on purchases made before the end of the month (and quarter).

Looking Ahead

Looking Ahead

Despite the difficulties ahead, there are some silver linings. The Conference Board’s consumer confidence index hit 108.3 in December, its highest reading since April 2022, as inflation eased and gas prices fell. A tight job market and low unemployment levels are also giving consumers a modicum of security.

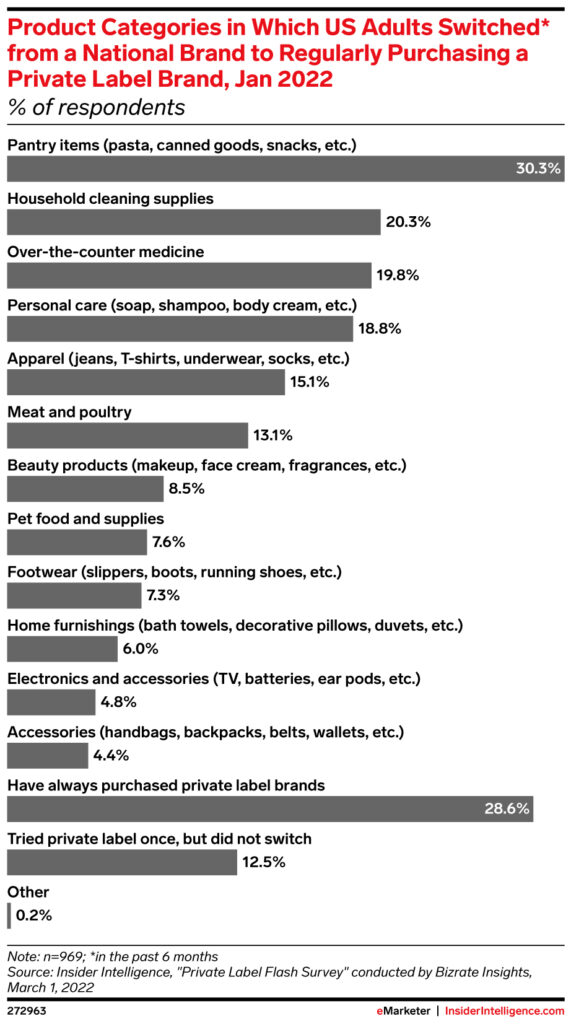

Still, the behaviors that developed over the course of 2022—a shift to private labels and value-oriented retailers, and the prioritization of essentials over discretionary goods—will remain in play in 2023 as consumers’ financial concerns guide their purchasing decisions.

Retail Category Performance

Retail Category Performance

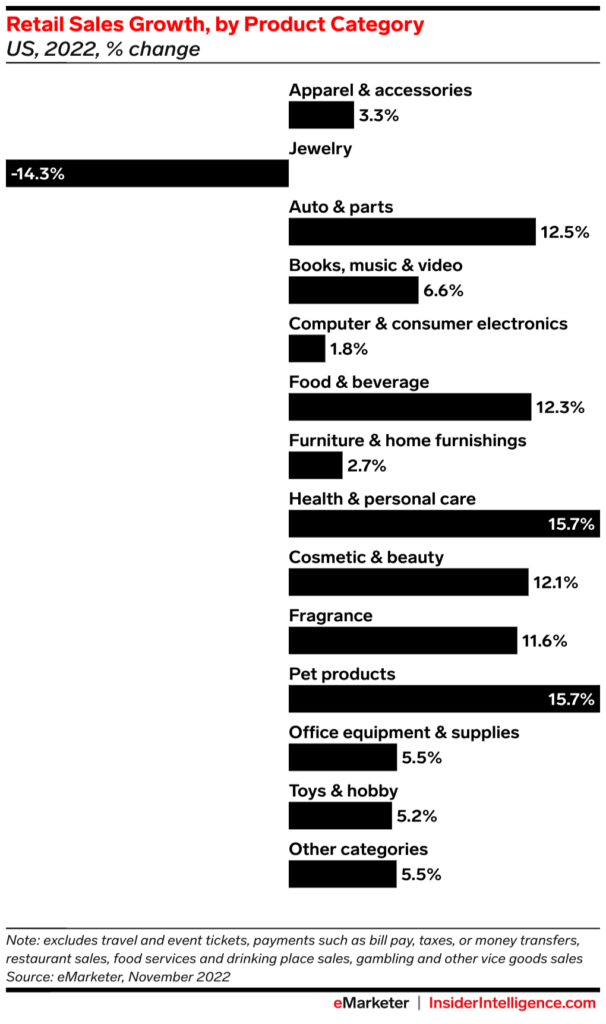

2022 was a tricky year for retailers to navigate, as rising inflation forced shoppers to make tough spending decisions. While consumer spending on the whole defied pundits’ gloomy projections, some categories outperformed others. Even with inflation beginning to ease, these spending trends are likely to continue well into 2023 as consumers grow more cost-conscious.

Who Won

Who Won

Unsurprisingly, some of the biggest category winners in 2022 were essentials like food and grocery and pet products. But others, like beauty and travel, speak to the spending power that many households continue to wield.

- Food and beverage sales rose 12.3% year-over-year (YoY), according to eMarketer retail sales forecast US retail sales forecast, driven mostly by inflation but also by a significant number of shoppers trading up to premium products and brands.

- Sales of pet products increased 15.7% as a boom in pet ownership during the pandemic drove higher demand for food, toys, and petcare.

- The health and personal care, cosmetics and beauty, and fragrance categories all saw double-digit growth in 2022 as consumers largely returned to in-person events and looked for relatively affordable ways to indulge.

- And consumers’ pent-up desires to eat out and travel came out in full force this year. Except for a small dip in July, restaurant spending rose steadily throughout 2022, although some of those gains came from inflation. Travel spending has also stayed strong: In November, consumers spent 16.2% more YoY on airfare, and 41.6% more YoY on lodging, according to Mastercard SpendingPulse.

Who Lost

Who Lost

Discretionary categories were hit hardest as they struggled to lap a year of relatively strong growth and consumers’ buying power diminished.

- Jewelry sales fell 14.3% YoY, with blockbuster growth in 2021 proving to be a difficult act to follow as macroeconomic pressures weighed on consumer spending.

- Computer and consumer electronics grew by an anemic 1.8% YoY, well below November’s 7.1% inflation rate, after shoppers stocked up during the first two years of the pandemic.

- Furniture and home accessories sales similarly failed to rise above inflation, growing by just 2.7%, as high interest rates caused more households to stay put and avoid big-ticket purchases.

Sales

Sales

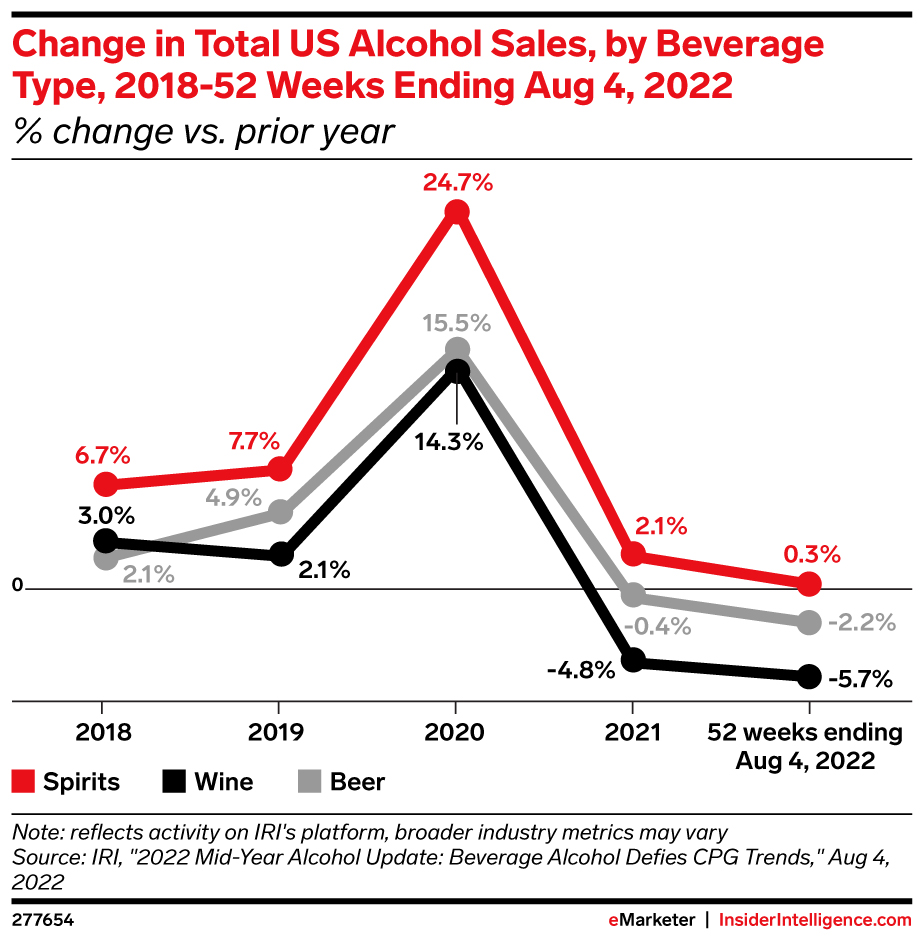

Inflation Takes a Toll on Beer Sales

Inflation Takes a Toll on Beer Sales

Consumers are displaying less willingness to swallow price increases for their favorite beer brands.

- Constellation Brands said higher-than-expected price increases across its beer portfolio softened demand during its fiscal Q3 ended November 30.

- Roughly one-third (34%) of US adults of legal drinking age plan to look for drink deals this year to help counter inflation, according to Drizly’s 2023 BevAlc Trend Report.

Like CPG brands, beer companies are using price increases to make up for decreases in sales volume—a tactic which has helped their bottom lines, but left them vulnerable to behavioral shifts as consumers grow increasingly price-conscious.

- After raising prices in Q3, Constellation reported that depletion growth (the number of cases sold to distributors) decelerated to 5.7% year-over-year (YoY) in Q3, a significant drop from 8.9% in the previous quarter.

- An analysis by Credit Suisse managing director Kaumil Gajrawala found that dollar sales per point of distribution were up 14% compared with 2019, but unit sales were just 1% higher—indicating that price hikes accounted for most of the growth seen by beer companies over the past three years.

- Constellation said it would slow price increases to 1% to 2% in fiscal 2024, down from 2% to 3% in fiscal 2023.

A Slowdown in Consumer Spending

A Slowdown in Consumer Spending

- Beer imports fell by 10.4% YoY in November, per Commerce Department data analyzed by the Beer Institute.

- In-store sales volumes of imported beers rose 4.2% in 2022 but fell 0.5% in the four weeks leading up to Christmas, per consulting firm Bump Williams’ analysis of Nielsen data, as reported by The Wall Street Journal.

- Premium brands also saw a drop in sales: Domestic superpremium labels fell 2.3% in the same period, despite more consumers trading up in the first half of the year.

While alcoholic beverages are one area where consumers are loath to cut back, more shoppers are trading down to cheaper brands to cut costs.

- For example, sales of prosecco picked up during the holidays as shoppers looked for cheaper alternatives to Champagne, Drizly’s head of insights Liz Paquette told The Journal.

- Retail store sales for wines in the $50 to $99.99 price range fell 4.5% YoY in 2022, per Bump Williams, as consumers gravitated toward products under $20.

That increased price sensitivity could benefit Molson Coors and Anheuser-Busch InBev, both of which have brands at lower price points, and slow premiumization efforts as companies scramble to adjust to changing consumption habits.

- At the very least, more brewers should follow Constellation’s example and scale back price hikes in 2023 to avoid losing market share to cheaper brands.

Brand Loyalty

Brand Loyalty

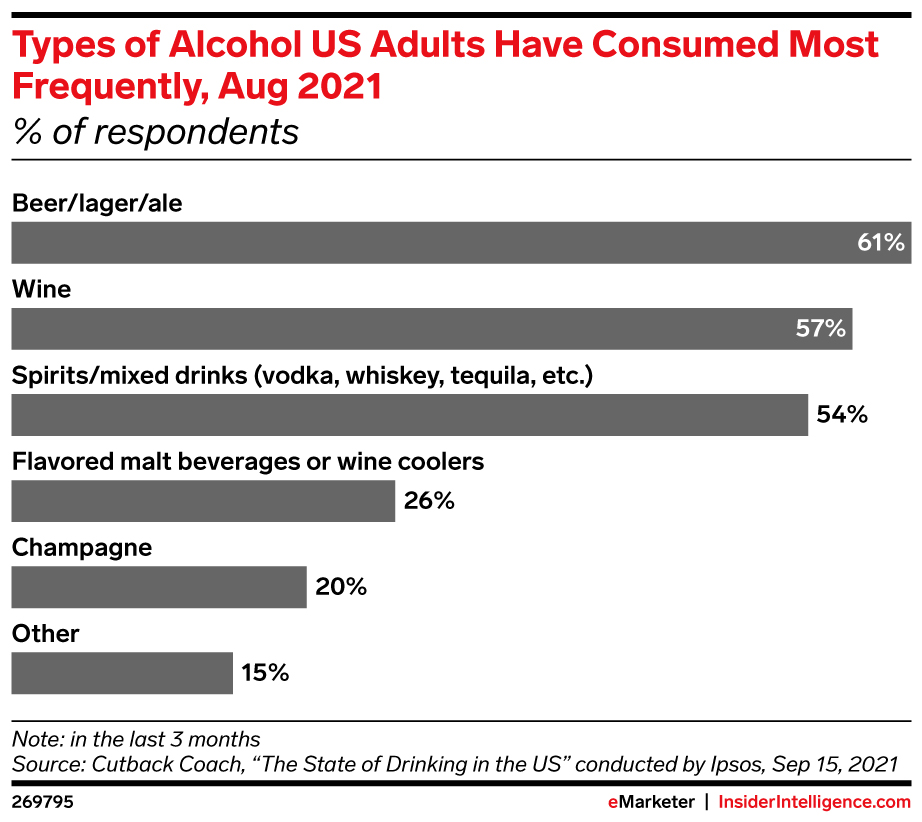

Despite rising beer prices, consumers are staying loyal to their favorite brands or trading up to premium labels.

Strong Performers

Strong Performers

- Molson Coors reported a 16.7% increase in net sales in Q1 2022, thanks in part to growing revenues for Coors Light and Miller Lite, two of its core brands.

- Constellation Brands reported an 11% year-over-year increase in net sales for its beer business for its 2022 fiscal year (ended February 28, 2022).

- Anheuser-Busch InBev’s Q1 revenues grew 11.1%, per its earnings release.

The Strategy

The Strategy

Like many other companies in the food space, beer brands are focused on premiumization and SKU rationalization in an effort to bring down manufacturing costs and convince customers to pay more.

- Molson Coors’ CEO Galvin Hattersley said in the company’s Q1 earnings call that cutting the brand portfolio in the US made Coors “stronger and more efficient,” enabling it to redirect resources to its biggest brands.

- Revenues for Anheuser-Busch InBev’s premium brands grew over 15% in Q1, CEO Michel Doukeris said on a recent earnings call, while the company’s premium portfolio generates over 50% of the total European revenues.

An Inflation-Proof Category

An Inflation-Proof Category

Hattersley noted that consumers are continuing to “trade up, not down,” behavior that tallies with what the company saw in previous economic downturns.

- That’s despite higher prices; Molson Coors implemented a 3% to 5% increase in early 2022, while both Anheuser-Busch InBev and Constellation Brands have instituted hikes this year.

- It helps that beer prices have risen more slowly than inflation, making consumers less likely to transition to cheaper brands as they’ve done in areas like groceries and apparel.

- While not many products can claim to be inflation-proof, brands that keep prices steady for longer could be rewarded with higher customer loyalty.

Strategic Partnership

Strategic Partnership

Coke Partners With Jack Daniel’s

Coke Partners With Jack Daniel’s

Coca-Cola has teamed up with Brown-Forman, the distiller behind Jack Daniel’s whiskey, to create a Jack-and-Coke cocktail in a can — available in Mexico before expanding to other markets.

- While this marks the soda giant’s fourth new alcoholic beverage in under two years, it has higher risk and reward, as it’s the first time the Coke brand itself is involved.

Ready-To-Drink (RTD) Category

Ready-To-Drink (RTD) Category

RTD mixed drinks have been on a tear lately. According to IWSR Drinks Market Analysis, ready-to-drink (RTDs) beverages have been the fastest-growing alcohol sector since 2018, snatching market share from beer.

Trading on brand equity is generally a win for brands, and this should be no different.

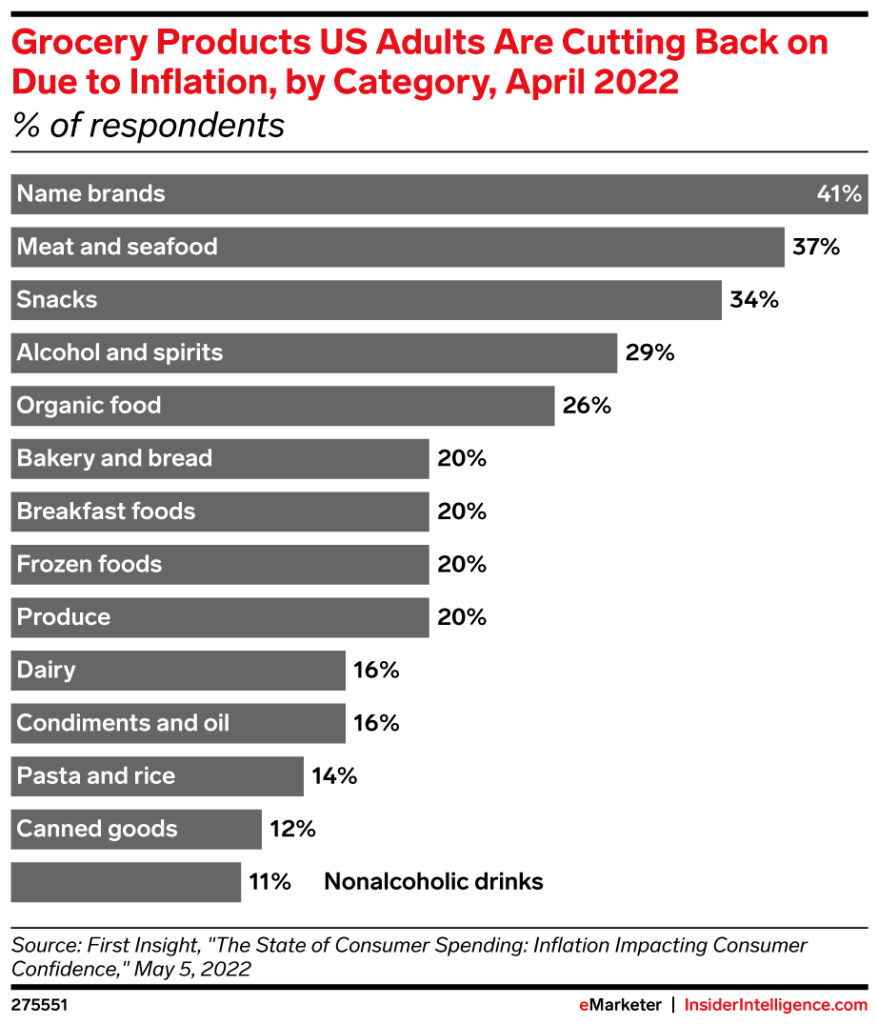

Timing is critical, too: With inflation on consumers’ minds, name brands (41%) and alcohol and spirits (29%) are two of the areas shoppers say they’re cutting back on, per First Insight.

Sustainability

Sustainability

Less Are Paying More for Sustainable Apparel

Less Are Paying More for Sustainable Apparel

While 71% of consumers reported being concerned about sustainability in apparel, only 12% made sustainable clothing purchases as a result, per Boston Consulting Group’s June 2022 global survey.

- Among US fashion consumers, 64% agreed that increased costs of living would drive them to prioritize price over sustainability when clothes shopping, per Nosto.

- Moreover, 56% agreed sustainable fashion is often too expensive.

Entertainment

Entertainment

US streaming revenues grew 17.3% in Q3 to $7.7 billion, showing resilience in the face of inflation and a possible economic downturn, per figures from the Digital Entertainment Group.

Big Streamers Carry the Torch

Big Streamers Carry the Torch

The beginning of the year was full of concerns that subscribers would suspend streaming services given mounting economic concerns, but recent earnings from major streaming companies show that they’re still willing to pay.

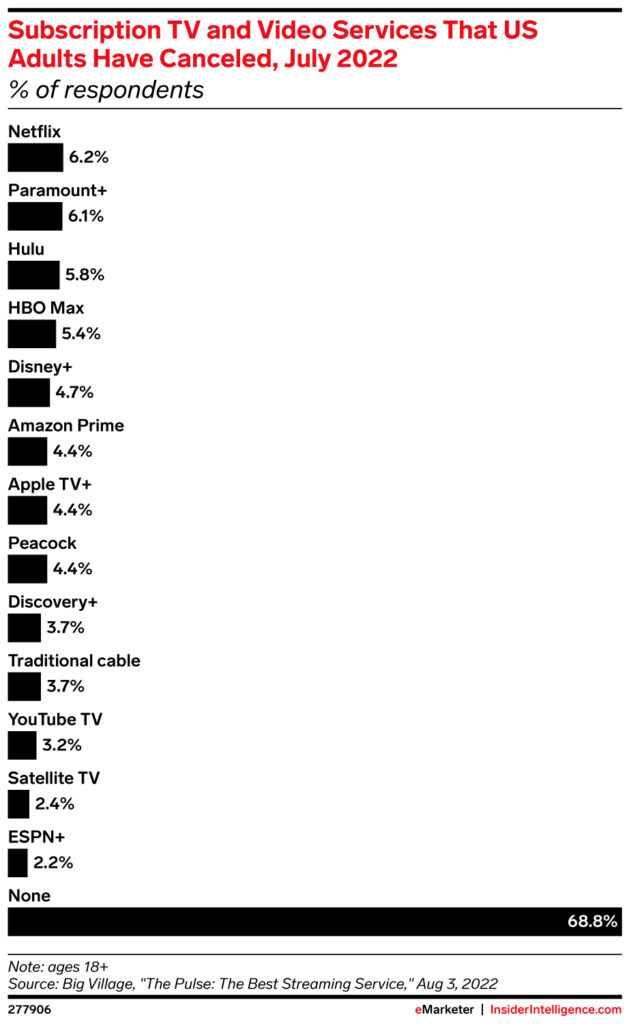

- In the lead-up to 2022, many suspected that fatigue from an overwhelming number of new subscription services would cause stagnation. Early on, that appeared to be true: Netflix posted its first-ever subscriber loss, and the rest of the year was marred by stories about consumers canceling subscriptions due to inflation.

- But now that the clouds have cleared somewhat, it appears that consumers are not canceling streaming subscriptions en masse. Sixty-eight percent of US adults have not canceled a subscription so far this year, per a Big Village survey.

- Netflix reversed those subscription misfortunes in its Q3 earnings report, adding 2.41 million subscribers. Disney+ similarly had a strong quarter (even if investors weren’t thrilled by revenues), adding a staggering 12.1 million subscribers. Even the debt-ridden Warner Bros. Discovery managed to reel in 2.8 million subscriptions.

Streaming As The De-Facto Entertainment Source

Streaming As The De-Facto Entertainment Source

Streaming is the de-facto entertainment source for a large number of Americans. Despite price hikes and the still-looming threat of a recession, consumers have shown that they’re willing to pay for streaming entertainment.

That’s good news for the industry leaders—HBO, Netflix, Disney+, and Apple TV will see subscriptions either slowly creep up or remain steady—but smaller competitors that were already struggling to maintain market share will feel the hurt.

Shopping

Shopping

Cost Cutting

Cost Cutting

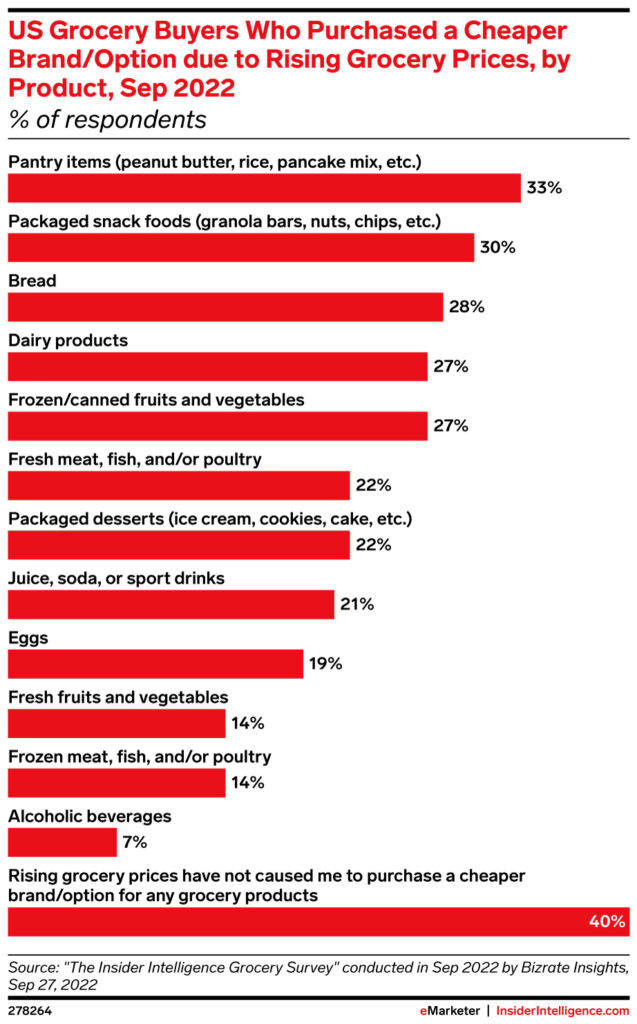

Grocery shoppers cut costs where and when they can to contend with soaring inflation. Consumers are feeling the pinch of soaring grocery prices and many are looking for opportunities to cut costs.

- Seventy-seven percent of consumers have stopped themselves from purchasing grocery items because their price is higher than normal, per CivicScience. That’s the highest point since tracking began in April.

- Seventy-two percent of respondents report cutting back in at least one category (such as snacks, organic foods, and eggs/dairy), up from 63% in January.

Shifting Spending Patterns

Shifting Spending Patterns

People are adjusting their shopping patterns as they shift more of their spending to discount stores and warehouse clubs.

- For example, Aldi’s US stores have generated double-digit growth over the last 12 months as consumers look for ways to cut costs amid soaring food prices, per Reuters. The retailer has added 1 million new customers thanks to a rise in the number of middle- and higher-income shoppers visiting its stores, said Scott Patton, Aldi’s vice president of national buying.

- Higher-income shoppers are also visiting Costco, BJ’s Wholesale Club, and Sam’s Club more often to take advantage of bulk-buying discounts and lower gas prices.

Spending

Spending

Consumers Spend More Cautiously

Consumers Spend More Cautiously

Consumers spend more cautiously as they struggle to evade inflation. US consumer spending growth slowed down considerably in February, increasing by only 0.2% thanks mostly to higher food and energy costs, per the US Department of Commerce.

- Real public consumer expenditures dropped by 0.4%, suggesting that people aren’t shopping more—they’re just compensating for increased prices for goods and services.

- Annual inflation hit 6.4% in February, according to the Federal Reserve.

- Retail unit sales dropped in nine of the first 10 weeks of 2022, in comparison to last year’s performance, per NPD Group.

Experiential Spend

Experiential Spend

Experiential spend is beginning to tick upward, gradually returning to pre-pandemic levels.

- Consumers spent 16% more on restaurants in 2021 than the year prior, the NPD Group found. In February 2022, consumer spending at restaurants was up 8% year over year.

- The travel industry is also seeing a rebound, despite higher ticket and fuel prices.

- But consumer sentiment remains at a decade low, as worries over inflation and the Russian invasion of Ukraine persist.

Price Consciousness

Price Consciousness

Discount retailers see an opportunity. Off-price retailers, like Five Below and Dollar General, are capitalizing on consumers’ price consciousness to expand their footprint considerably.

- Five Below plans to open up to 400 new stores in fiscal 2022 and 2023, and up to 600 more stores in the subsequent two fiscal years, CEO Joel Anderson announced.

- Dollar General sought to open 1,110 stores in 2022.

- Discount retailers are hoping that customers who begin shopping with them due to budget concerns will remain loyal even when prices stabilize, but they’ll have to be able to engage shoppers in other ways beyond price if they want them to stay.

Behavior Shifts

Behavior Shifts

Unsurprisingly, lower-income consumers are already starting to adjust the products they buy. Analysts from RBC Capital Markets noted that shoppers are beginning to trade down in the cigarette and beer categories, although spending habits among high earners are expected to be unchanged.

- Increased food costs are also hitting certain demographics harder than others: On average, Hispanic, Latino, and African American households spend a larger share of their income—12.5%—on food than other ethnic groups, according to data from Bank of America.

- With food prices 8% higher than they were in February 2021, lower-income shoppers will continue to turn to retailers that can provide the most value.

Shifts in Consumer Behavior

Shifts in Consumer Behavior

5 consumer behaviors that will define retail in 2023

“The sky isn’t falling,” according to The New Consumer and Coefficient Capital’s “Consumer Trends 2023” report. But consumer habits are changing as a result of high inflation, shifting attitudes around COVID-19, and the battle for digital attention. Here are our key takeaways from the report.

Inflation is high and consumer sentiment is not. But it’s rebounding.

Inflation is high and consumer sentiment is not. But it’s rebounding.

- According to the US Bureau of Labor Statistics, inflation has seen some relief since hitting a 40-year high in June. But 64% of US consumers still say prices for everyday goods have increased a lot in the past six months, per The New Consumer and Coefficient Capital.

- The University of Michigan’s index of consumer sentiment noted a 4.0% rise in consumer sentiment between December and November. But sentiments are down 16.3% since last December.

- Nearly half (47%) of US adults say inflation is the most important problem in the US right now, putting it far ahead of issues like gun violence, climate change, and COVID-19, according to The New Consumer and Coefficient Capital.

Sentiments have improved, but consumers are hurting from inflation. That will extend into next year, and consumers will keep searching for ways to cut back.

TikTok is making them buy it.

TikTok is making them buy it.

- The No. 1 use for TikTok is mindless entertainment, but nearly one-fourth (23%) of US users say they use the platform for discovering new products to purchase. One-fifth say they use it to keep up with brands, according to The New Consumer and Coefficient Capital’s survey.

- Some 27% of those surveyed say they have purchased a product because of a TikTok video.

- According to our own data, 27.3% of US TikTok users have purchased something using the platform. By 2026, we forecast that number will reach 39.9%.

- Among Gen Z, 19% say they primarily discover beauty products on TikTok.

TikTok is converting users into shoppers with rapid speed. The app puts entertainment and shopping in the same place, offering users the same magical shine of going to the mall in the ’90s. Despite rising inflation, ecommerce will continue to go viral on TikTok.

Creator- and celebrity-backed brands will keep their advantage.

Creator- and celebrity-backed brands will keep their advantage.

- Creator- and celebrity-backed brands like Skims, The Honest Company, and Fabletics have a leg up in advertising because creators already have a social media audience to whom they can advertise.

- An established audience will become even more advantageous as marketers sift through the loss of third-party data in the year ahead.

- Celebrity-founded beauty brands have an Instagram engagement rate of 13%, compared to non-celebrity-founded brands’ 3% engagement rate, according to a Charm.io study reported by The New Consumer and Coefficient Capital.

Celebrity- and creator-backed brands will remain in vogue next year, especially as marketers struggle to reach consumers with targeted ads. But pairing with celebrities isn’t always the safest bet. Take adidas and Gap Inc., which lost hundreds of millions in profits when they parted ways with Kanye West following his racist and antisemitic remarks.

Consumers would rather forget COVID-19.

Consumers would rather forget COVID-19.

- COVID-19 is the least of US adults’ concerns right now (although the pandemic is not over), according to The New Consumer and Coefficient Capital.

- Metrics like air travel bookings and dinner reservations have effectively returned to what they were in 2019, according to the TSA and OpenTable data reported by The New Consumer and Coefficient Capital.

- Some pandemic habits have slowed but not stalled. Grocery delivery intermediary sales growth has decreased significantly from 215.5% in 2020, but growth remains in the double digits, meaning the behavior itself has stuck around.

A lot of retail behaviors have normalized, and people have returned to stores and restaurants. But a lot of accelerated ecommerce adoption will stick around, even as growth slows.

Consumers with wealth lean into health.

Consumers with wealth lean into health.

- Wealthy consumers (those making more than $150,000 per year) are more likely to make health and wellness a high priority next year, according to The New Consumer and Coefficient Capital.

- That could have major retail implications, considering the leading potential lifestyle changes involve food, exercise, and supplements.

- Health and personal care was the third-fastest-growing ecommerce category this year at 22.1% year-over-year growth, behind food and beverage and pet products. Next year, the category will rise to the No. 2 spot, though growth will slow to 18.4%, according to our forecast.

- Delivery startup Gopuff is leaning into wellness with its private label line, Goodnow.

Brand Response

Brand Response

Many brands are looking for ways to pivot to messaging and strategies that are more likely to resonate with inflation-wary consumers—though some industries aren’t feeling the pressure to shift strategies (yet).

Carpe Diem

Carpe Diem

T-Mobile is launching a campaign dubbed Coverage Beyond targeted at summer travelers.

- Through Labor Day, the carrier will provide savings at Shell gas stations, a complimentary one-year membership to AAA, free Wi-Fi on some flights, and better international internet rates in a select number of European countries.

Focusing on Value

Focusing on Value

Without mentioning inflation directly, Del Taco’s “We Get It” campaign earlier last year used humor (gas at $5,333; used cars approaching $1 million apiece) to promote its “20 Under $2” menu.

- The fast food chain’s CMO Tim Hackbardt told Fortune at the time that many of its competitors were abandoning the value category in wake of rising inflation and that it was working to take advantage of the situation.

Campaign Creativity

Campaign Creativity

Food conglomerate Kraft has simplified the branding for its macaroni and cheese to support the idea of “positive comfort,” officially changing the name to Kraft Mac & Cheese based on how consumers refer to the product. The packaging, set to debut in August, will highlight the updated noodle-smile logo, which will now have cheese dripping from it.

- The consumer goods firm joins others in implementing rebrands designed to update venerable products and lean into evolving customer preferences.

- The campaign includes a TikTok challenge, suggesting a desire to engage the brand’s younger target market that prefers the video-sharing app.

- The “positive comfort” theme connects to the idea of self-care among millennials, a generation that has shifted away from conventional packaged meals in favor of organic offerings, but given inflationary concerns, might be willing to give packaged staples another chance.

One Size Doesn’t Fit All

One Size Doesn’t Fit All

- Beer firms Molson Coors, Constellation Brands, and Anheuser-Busch InBev recently posted positive earnings, suggesting that inflation concerns aren’t hitting all categories equally.

- Fashion brands seem to have largely benefited as consumers update their wardrobes to reflect busier post-pandemic social calendars. Case in point: Doc Martens posted 43% growth in pretax profits in its most recent quarter.

- Luxury brands don’t seem to be that worried, either.

- Some conglomerates, including Kimberly-Clark, have used inflation as cover to boost their margins.

While inflation has historically bolstered ad spend as is often taken into account in advertising budgets, that’s not likely to happen this time. The overall uncertainty will have a negative impact on marketers’ budgets.

- While consumers will be spending less, their underlying needs won’t be any different—but they could be looking to more affordable products to meet them.

- Some categories will naturally benefit from inflation—and savvy advertisers will run campaigns that assuage consumer concerns.

Author

Designing consumer-centric marketing initiatives that generate incremental revenue through digital strategy, management, and innovation.

Retail Category Performance

Retail Category Performance Sales

Sales Brand Loyalty

Brand Loyalty Strategic Partnership

Strategic Partnership Sustainability

Sustainability Entertainment

Entertainment Shopping

Shopping Spending

Spending Shifts in Consumer Behavior

Shifts in Consumer Behavior Brand Response

Brand Response