Big retailers like CVS, Walgreens, and Amazon are bringing technology-centric care to consumers, while also boosting their own bottom lines.

Key Takeaways

Key Takeaways

Retailers want a piece of the $4.3 trillion US healthcare pie. They’re now investing billions of dollars in healthcare companies and platforms to fortify their internal clinic and pharmacy offerings.

These players will disrupt the industry by bringing convenient, technology-centric care to consumers, while also boosting their own bottom lines. Incumbent providers will feel mounting pressure to match the competition.

Retailers are making multibillion-dollar healthcare investments and acquisitions.

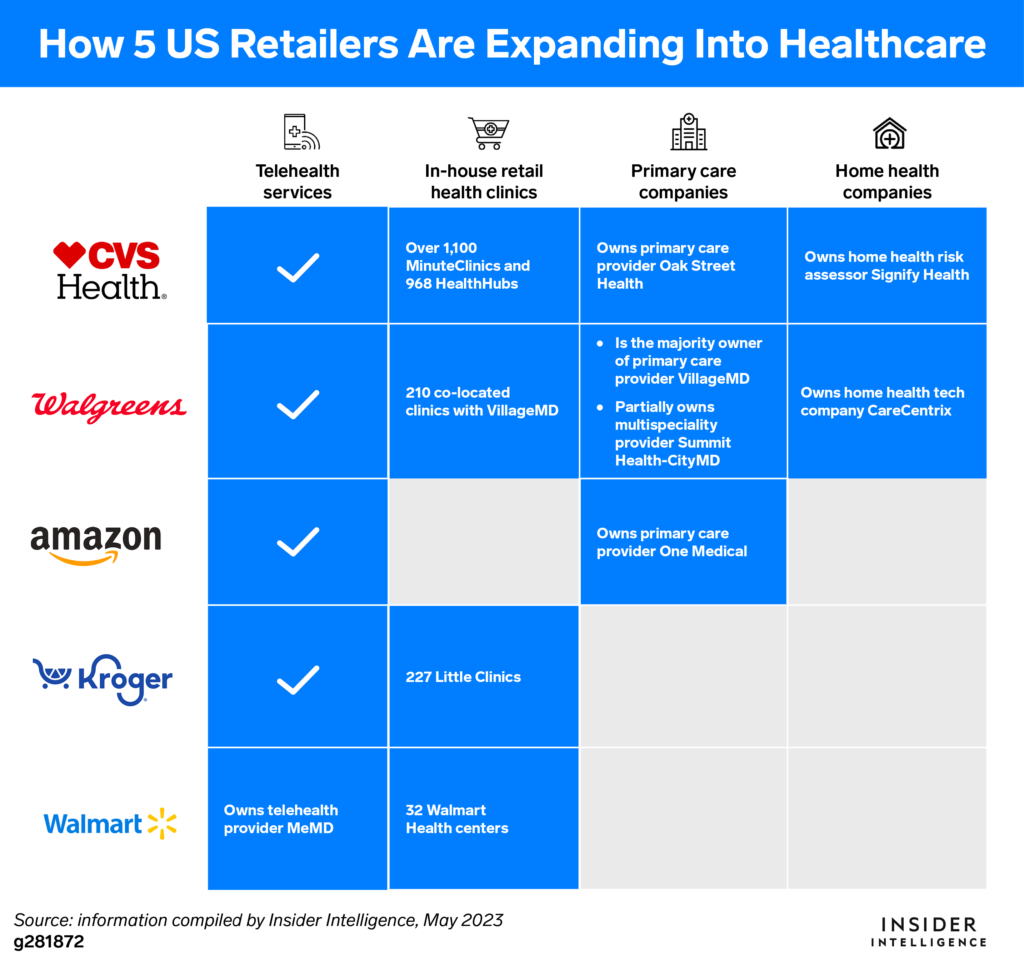

Big retailers are accumulating assets from across the healthcare ecosystem. This includes adding pharmacy and health insurance capabilities, as well as provider services such as home health, telehealth, primary, specialty, and urgent care.

Retailers want to establish a presence in the $4.3 trillion US healthcare market.

Retailers want to establish a presence in the $4.3 trillion US healthcare market.

The US spends more per capita on healthcare than any other developed nation, according to The Commonwealth Fund, yet patients still struggle to access convenient and affordable care. Retailers are seizing the opportunity to challenge incumbent providers on their ability to deliver tech-focused accessible care with transparent pricing—while also profiting from the potentially lucrative value-based care (VBC) market.

CVS Health, Walgreens, and Amazon have been on healthcare buying sprees over the past year.

CVS Health, Walgreens, and Amazon have been on healthcare buying sprees over the past year.

CVS spent nearly $19 billion to acquire senior-focused primary care player Oak Street Health and home health tech company Signify Health; Amazon dropped $3.9 billion on primary care startup One Medical; and Walgreens-backed VillageMD teamed up with Cigna to buy multispecialty physician group Summit Health, the parent entity of urgent care provider CityMD, for $8.9 billion.

Retailers keep adding pieces to their healthcare portfolios.

Retailers keep adding pieces to their healthcare portfolios.

For example, CVS already owns health insurer Aetna and a pharmacy benefit manager, Caremark. Walgreens’ VillageMD augmented its Summit Health buy with an acquisition of multispecialty group Starling Physicians in March 2023. And last year, Walmart—which bought telehealth company MeMD in 2021—entered into a 10-year partnership with UnitedHealth Group.

Consumers value what many established healthcare providers aren’t offering.

Retail clinics have been around for two decades, but the pandemic underscored their benefits to consumers—namely, that healthcare can be accessible, speedy, and convenient.

Primary care physician (PCP) shortages are disrupting patient care.

Primary care physician (PCP) shortages are disrupting patient care.

Almost half of US counties had primary care doctor scarcities as of December 2022, with only one PCP for every 1,500 residents, per Surescripts data. Additionally, US patients in major cities wait an average of 20.6 days to get a new patient appointment with a family medicine doctor, according to a May 2022 survey from Merritt Hawkins.

Convenience trumps loyalty as consumers seek out more accessible and efficient care.

Convenience trumps loyalty as consumers seek out more accessible and efficient care.

Half of US adults will change doctors to find an available appointment, and one-third will switch to a provider who offers a shorter wait time, according to a November 2022 survey from PatientPop. Retail clinics typically offer same- or next-day appointments with nighttime and weekend hours. Many also have online tools that enable patients to check prices, verify insurance eligibility, and schedule visits.

Patients are getting more comfortable with retailers providing healthcare services.

Patients are getting more comfortable with retailers providing healthcare services.

US retail pharmacies have collectively administered more than 300 million COVID-19 vaccines, per the Centers for Disease Control and Prevention. Those experiences triggered visits to retail clinics for treating a range of low-acuity conditions. Some 71% of US healthcare executives believe the pandemic changed patient views on retail clinics for the better, per a November 2022 survey from The New England Journal of Medicine (NEJM).

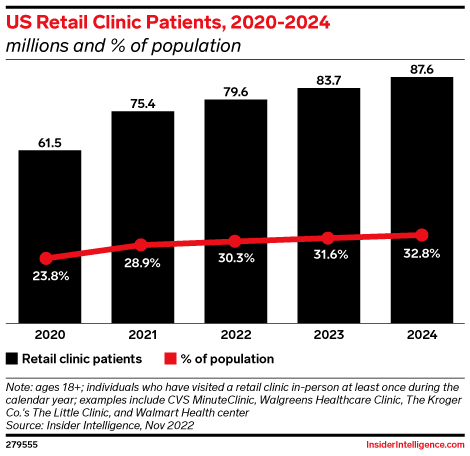

We forecast that more patients will go to retail clinics and fewer to PCPs through 2024.

We forecast that more patients will go to retail clinics and fewer to PCPs through 2024.

About 2.7 million fewer US adults will see a PCP in-person in 2024 than in 2022, per our estimates. Conversely, the share of US adults who visit retail clinics has grown annually since 2019 and will approach one-third (32.8%) in 2024.

Most patients get retail clinic care at CVS and Walgreens.

CVS and Walgreens will account for nearly 4 in 5, or 78.1% of, US retail clinic patients in 2023.

CVS and Walgreens will account for nearly 4 in 5, or 78.1% of, US retail clinic patients in 2023.

We define retail clinic patients as adults who get care in a retail business’s location, such as a grocery store or pharmacy. CVS’s MinuteClinics and HealthHubs are positioned inside its stores across dozens of states and staffed mostly by physician assistants and nurse practitioners. Walgreens and VillageMD co-branded clinics are situated next door to Walgreens pharmacies in 14 states. Walgreens also provides care through its in-store Healthcare Clinics, operated by external partners.

Other retailers are in the health clinic game, too.

Other retailers are in the health clinic game, too.

Some 90% of US-based retail clinics are owned by six entities, according to March 2023 research by Definitive Healthcare. Other than CVS and Walgreens, these organizations include Walmart, which plans to expand to more than 75 health centers in eight states next year; The Kroger Co., with Little Clinics spread across select grocery stores in nine states; and Target, which taps Kaiser Permanente to deliver care in more than 30 Southern California stores.

Services vary by location, with many retail clinics improving their health offerings.

Services vary by location, with many retail clinics improving their health offerings.

Most provide in-person and virtual care for nonemergency illnesses and injuries. Some also offer chronic care management and mental health treatment. Walmart Health’s expanded services include medical imaging and dental and optical care.

Some retailers hope their health clinics will boost other sales

Retailers are opening health clinics as they close stores.

Retailers are opening health clinics as they close stores.

CVS is on track to shut down nearly 10% of its stores by 2024, per its Q1 2023 earnings call. Walgreens and Walmart are also closing stores, albeit on a smaller scale. But each entity has plans to build more health clinics and offer expanded health services.

Clinics that are located in stores or adjacent to pharmacies could boost front-of-store and prescription sales.

Clinics that are located in stores or adjacent to pharmacies could boost front-of-store and prescription sales.

For example, about half of patients at VillageMD clinics that are located next to a Walgreens pharmacy chose to fill their prescriptions there, Walgreens said on its Q2 2023 earnings call. Walmart is also redesigning its health clinics and moving them inside stores. These retailers are envisioning a world in which consumers come in for a healthcare appointment, pick up their medications, and grab some household items on the way out.

Amazon is betting on One Medical’s patients to be a boon for the retail giant’s underwhelming pharmacy unit.

Amazon is betting on One Medical’s patients to be a boon for the retail giant’s underwhelming pharmacy unit.

Amazon Pharmacy is a convenient option for many of One Medical’s 836,000 members across 221 clinics to fill their prescription medications. But Amazon’s Rx business has struggled to gain traction since its November 2020 launch—only 2% of Prime members said the pharmacy was their reason for having the membership, per a Morgan Stanley survey cited by Insider in August 2022.

Value-based care could be retailers’ revenue growth engine.

Healthcare providers are betting on preventive primary care to reduce expensive medical interventions.

Value-based primary care for seniors is a $700 billion total addressable market.

Value-based primary care for seniors is a $700 billion total addressable market.

That’s according to a September 2022 estimate by Humana president and CEO Bruce Broussard. The moneymaker is the rapidly growing Medicare Advantage (MA) program—a value-based payment model in which the federal government financially incentivizes doctors and insurers to lower patients’ medical expenses and keep them out of the hospital. Payers and providers share the profits if they can effectively manage sicker patients’ costs.

VillageMD gives Walgreens access to the provider’s value-based contracts.

VillageMD gives Walgreens access to the provider’s value-based contracts.

The primary care provider served 440,000 patients in value-based payment contracts as of Q1 2023. In its most mature markets, VillageMD generated savings of $2,400 per MA patient per year, Walgreens said in the previous quarter’s earnings call.

CVS plans to parlay Signify and Oak Street into a VBC giant.

CVS plans to parlay Signify and Oak Street into a VBC giant.

Over 98% of Oak Street’s 2022 revenues were generated from VBC contracts, meaning CVS’s MA enrollment is primed to grow beyond its 11% market share, per KFF estimates, in the coming years. And Oak Street could reel in new members by getting referrals from Signify, whose home health risk assessments will help pinpoint which seniors don’t have a primary care physician.

Walmart hopped aboard the MA gravy train via a 10-year VBC partnership with UnitedHealth Group.

Walmart hopped aboard the MA gravy train via a 10-year VBC partnership with UnitedHealth Group.

Hundreds of thousands of MA members will be able to get in-network care at 15 Walmart Health centers in Florida and Georgia through the new tie-up. Walmart and UnitedHealth are also launching a co-branded MA plan in Georgia. The partnership could bring a flood of new MA members to both companies—UnitedHealth is already the biggest MA insurance provider, with nearly 8 million enrollees as of March 2022, according to KFF data.

Retailers’ reputations will help determine their success in healthcare.

Consumers likely won’t get care at places they don’t trust.

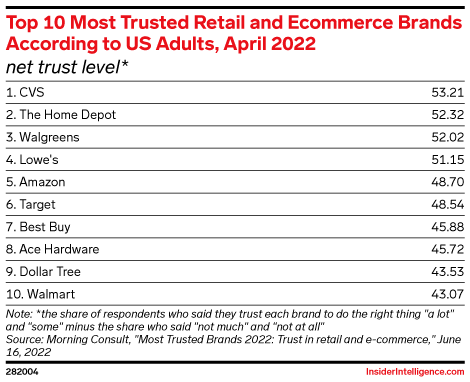

CVS and Walgreens have earned consumer trust as retail brands.

CVS and Walgreens have earned consumer trust as retail brands.

Their efforts in COVID-19 vaccine distribution are likely a big reason why. CVS ranked first and Walgreens third on Morning Consult’s 2022 list of the most trusted retail and ecommerce brands, as rated by US adults. Amazon came in fifth, and Walmart placed 10th.

But will patients trust retailers as healthcare providers in a post-pandemic world?

But will patients trust retailers as healthcare providers in a post-pandemic world?

Patients’ reliance on retail pharmacies for in-store COVID-19 tests and vaccinations is waning. Retailers must prove to consumers that their expanded scope of healthcare services brings them closer to being trusted care providers.

Retailers’ brand reputations likely vary by population.

Retailers’ brand reputations likely vary by population.

For example, Walgreens’ initial decision not to dispense an abortion medication even in some states where abortion is legal sparked a widespread boycott. Walgreens has since confirmed it will provide the medication in states where it’s legally permitted to do so. Other retailers such as CVS and Walmart have not been as outspoken on the matter thus far.

Older consumers are the most difficult to capture, but they present a key opportunity for retail healthcare.

Older consumers are the most difficult to capture, but they present a key opportunity for retail healthcare.

Just 10.6% of US retail clinic patients will be ages 65 or older this year, per our estimates. But 60% of seniors have multiple chronic conditions, which require frequent medication refills and provider check-ins, according to the National Institutes of Health. Retailers offering healthcare services should see this as a key growth opportunity and adjust their marketing accordingly.

The primary care market is still big enough for established healthcare providers.

CVS’s Aetna business makes it the most imposing retail health disruptor.

CVS’s Aetna business makes it the most imposing retail health disruptor.

Nearly half (47%) of US healthcare executives named CVS as a threat to health systems’ core business in 2023, while just 10% considered it “non-consequential,” per a December 2022 Health Tech Nerds survey. “Payviders’’—the combination of a payer and provider—have substantial power in local markets and can influence patient decisions on where to get care.

Amazon and Walmart are lurking as potential competitors.

Amazon and Walmart are lurking as potential competitors.

More than half (52%) of respondents in the Health Tech Nerds survey saw Amazon as a threat to health systems. (Never count out the ecommerce giant as a disruptor to any industry.) And with over 3,500 US stores, Walmart has the footprint to become a primary care giant in the rural US, where physician shortages will hit hardest.

But retailers are making only a dent in the nearly $300 billion primary care market.

But retailers are making only a dent in the nearly $300 billion primary care market.

Even by 2030, retail players may account for only 5% to 10% of total primary care in the US, according to a July 2022 analysis from Bain & Company.

How should traditional providers respond to retailers’ healthcare ventures?

Be willing to partner with retailers.

Be willing to partner with retailers.

Prominent health systems such as Advocate Health Care, Providence, Kaiser Permanente, and Cleveland Clinic either provide care in retail pharmacies or are clinically affiliated with one. This approach will boost referrals for health systems while saving them the costs of maintaining their own outpatient practices. For example, Providence recently shut down 27 of its ExpressCare clinics in Southern California, citing lower-than-anticipated patient volumes as one reason.

Recognize that meeting patients’ same-day care needs often isn’t possible.

Recognize that meeting patients’ same-day care needs often isn’t possible.

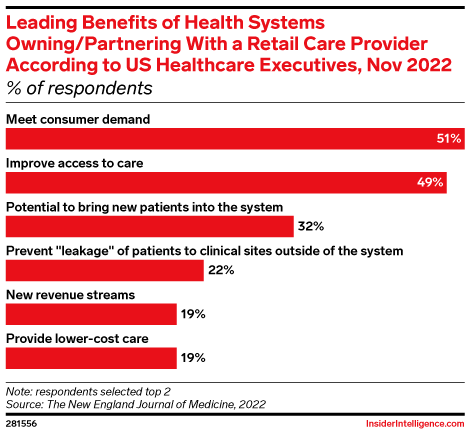

According to the US healthcare executives in NEJM’s survey, the top two reasons why health systems should own or partner with a retail care provider were meeting consumer demand (51%) and improving access to care (49%). This is especially important in medically underserved areas, which is where nearly half of Village Medical at Walgreens practices are located.

Use the blueprint created by retailers.

Use the blueprint created by retailers.

Retailers don’t have the history of medical expertise that conventional providers do, but they’ve addressed several of healthcare’s customer service shortcomings. Health systems that offer digital tools such as self-scheduling, app-based messaging, and price listings for services are on the path to catching up to retailers.

What does all this mean for healthcare providers and retailers?

Retailers and incumbent providers will need to differentiate their health services to stay competitive.

Retailers and incumbent providers will need to differentiate their health services to stay competitive.

Consumers will continue shopping around for care and trying out new providers. Retail clinics got the COVID-19 bump, but that advantage is fading.

Retail health players must meet the highest standard of consumer trust.

Retail health players must meet the highest standard of consumer trust.

Retailers will need to go all in as “healthcare companies” if they want to build patient loyalty (for example, following CVS’s lead on halting tobacco sales). Once healthcare trust is broken, it’s tough to repair.

As retailers increase healthcare investments and acquisitions, their threat to incumbent providers will grow.

As retailers increase healthcare investments and acquisitions, their threat to incumbent providers will grow.

Though retailers are far from overtaking established primary care providers in market share, their overall potential in healthcare is significant. It’s not just about in-store clinics; these companies are aiming to become vertically integrated healthcare giants.

Retailer-health system tie-ups can help reel in patients.

Retailer-health system tie-ups can help reel in patients.

Retailers that partner with health systems should make it clear to consumers that they’re aligning with a credible organization. And providers will want to advertise to patients that they now have options for same-day care at convenient locations. Co-branding could bring more consumers and patients into both ecosystems.

Key Takeaways

Key Takeaways