The biggest digital ad format is ripe for revolution.

Microsoft and Google are racing to develop the best AI-assisted search experience, leaving advertisers on the precipice of major disruption in the largest and most mature digital advertising channel. But the only certainty is that disruption is coming, and quickly. Everything else—even the fate of the open web—is up in the air.

Key Takeaways

Key Takeaways

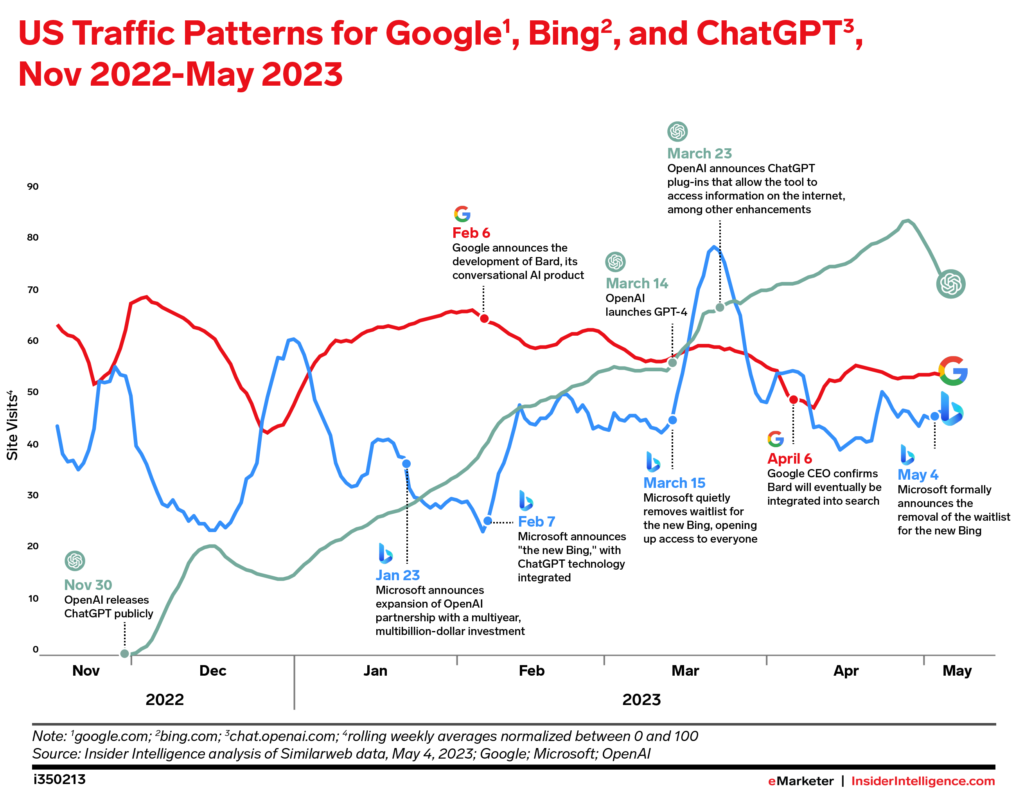

![]() More users are trying Bing thanks to its GPT-4 integration, but they haven’t made a permanent switch.

More users are trying Bing thanks to its GPT-4 integration, but they haven’t made a permanent switch.

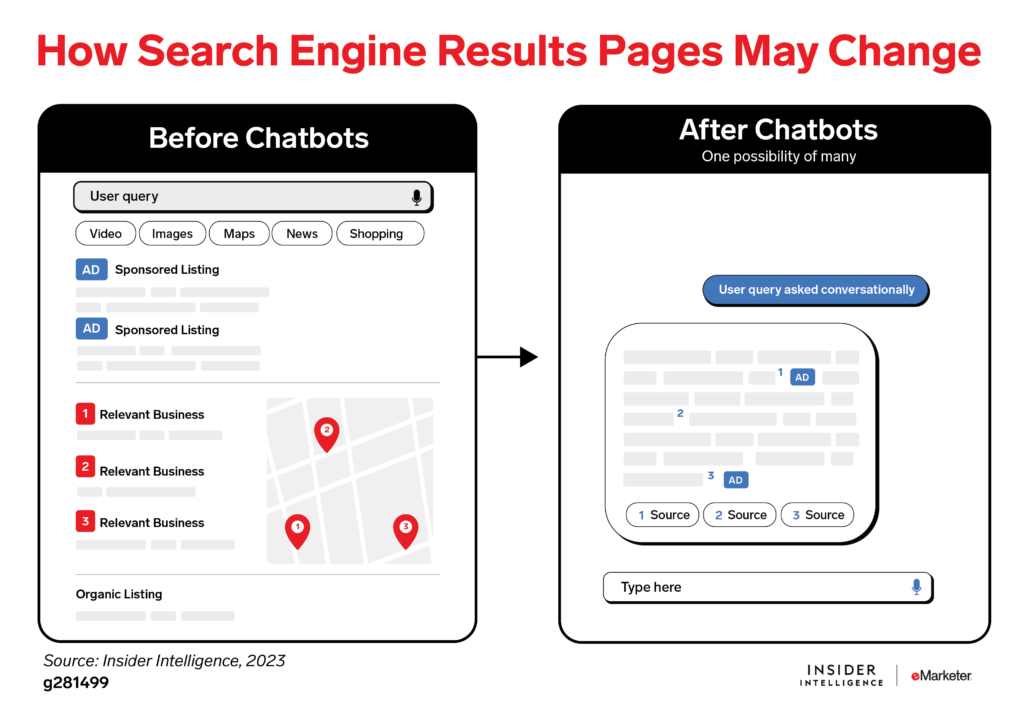

![]() It’s yet unclear how the market will support search ads in a conversational interface.

It’s yet unclear how the market will support search ads in a conversational interface.

![]() AI-enabled search will likely reduce publisher site traffic, with major consequences for programmatic.

AI-enabled search will likely reduce publisher site traffic, with major consequences for programmatic.

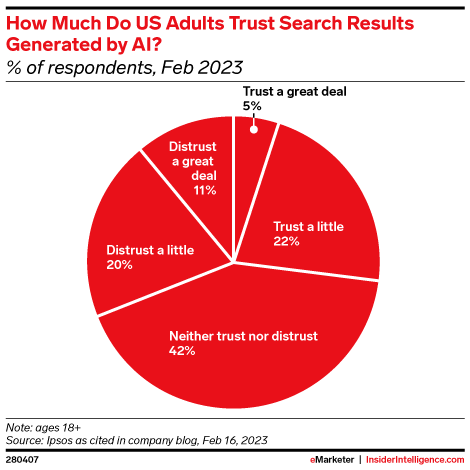

![]() Despite the hype, consumers are dubious about AI-assisted search.

Despite the hype, consumers are dubious about AI-assisted search.

Google is still dominant, but Microsoft has snatched a first-mover advantage with AI-assisted search.

OpenAI’s ChatGPT was an immediate success, gaining 1 million users within five days of its release, per data.ai (formerly App Annie). It was only a matter of time before Big Tech revved the AI growth engine. In February, Microsoft launched a chatbot-style interface run off OpenAI’s GPT-4 large language model and called it the new Bing. Google, already defending its share of the search advertising market against Amazon and TikTok, rushed to compete.

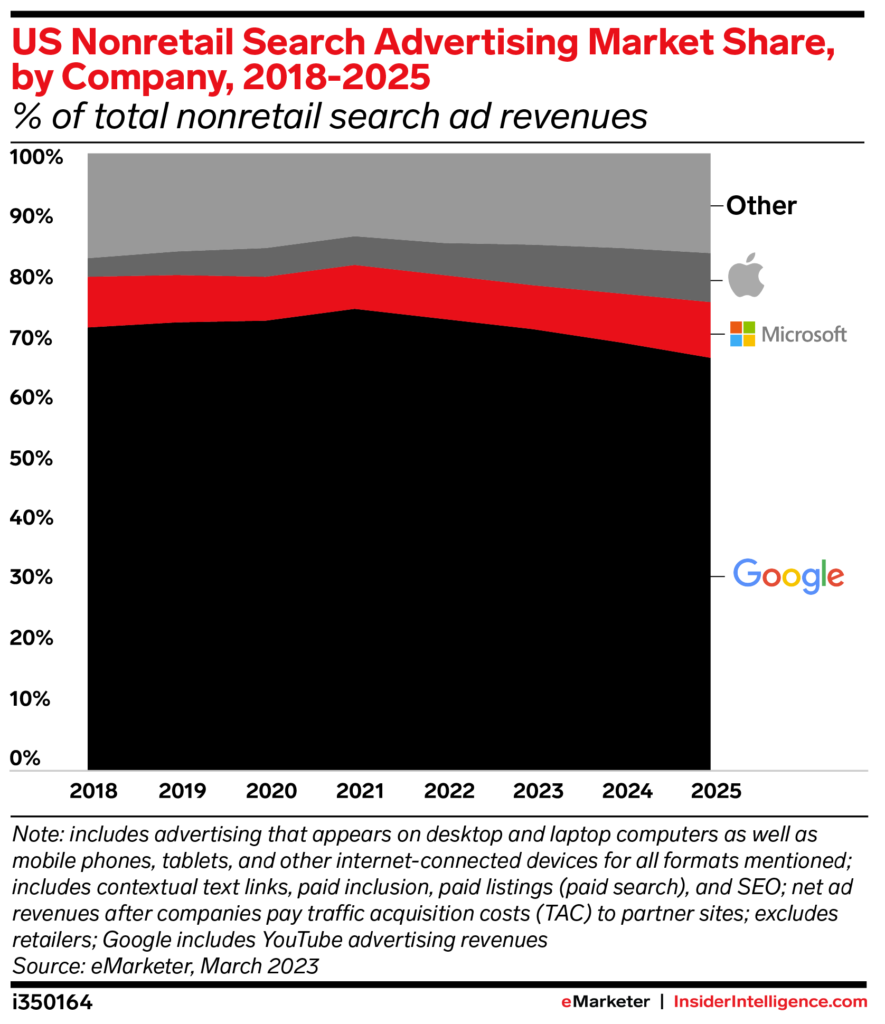

Microsoft’s US search ad revenue growth will outpace Google’s.

Microsoft’s US search ad revenue growth will outpace Google’s.

Its 9.0% growth rate is more than three times what Google will achieve this year, and that margin will widen over the next few years, according to our forecast. By 2025, Microsoft will account for nearly 9% of the nonretail search ad market and 6.0% of the market overall.

But Google will remain the top dog in search.

But Google will remain the top dog in search.

Its ubiquity is its biggest strength—it’s still the default search engine on most smartphones and browsers. Apple launching a search engine would have far greater disruptive potential to Google’s dominance.

More users are trying Bing thanks to its GPT-4 integration, but they haven’t made a permanent switch.

As the so-called AI arms race heats up, US site visit data from digital intelligence platform Similarweb reflects early changes in consumer behavior.

Bing has captured more traffic.

Bing has captured more traffic.

On March 8, Microsoft announced Bing had surpassed 100 million daily active users worldwide. The new Bing made its public debut shortly thereafter, and since then, its US site visits have spiked. But growth hasn’t been consistent, and it remains to be seen whether a critical mass of users will adopt Bing in the long run.

Google has lost a little traffic.

Google has lost a little traffic.

With no fewer than 460 million visits per day from US users between November 2022 and early May 2023, it still dwarfs Bing, which peaked at 13.8 million daily visits during the same period, per Similarweb. But responses to its chatbot, Bard—which opened for public access on May 10—have been generally negative, and it’s unclear how long users will have to wait for generative AI to be integrated into Google Search. If Google can’t recover from its AI fumbles, its site traffic might continue to slowly erode.

ChatGPT itself is also winning a lot more traffic.

ChatGPT itself is also winning a lot more traffic.

But it started from zero, and it’s much more than a search engine. We expect it will continue its upward trajectory as consumer awareness spreads and more businesses integrate AI tools into their daily workflows.

Other search players, including Neeva, Brave, DuckDuckGo, Yelp, and Baidu, have also thrown their hats in the ring with AI-assisted products.

It’s yet unclear how the market will support search ads in a conversational interface./h2>

Monetization of AI-assisted search answers isn’t as straightforward as that of conventional search engine results pages. Right now, there are more questions than answers—and quite a few concerns.

There will be less—or less prominent—ad space.

There will be less—or less prominent—ad space.

The way chat answers are displayed draws the eye to one place on the search results page, and with fewer high-impact placements, costs will likely rise.

Measurement will have to catch up.

Measurement will have to catch up.

Clickthrough rates won’t be a reliable indicator of exposure anymore—if they ever were. Measurement infrastructures will adapt accordingly, but it will take time.

Regulatory risks abound.

Regulatory risks abound.

AI is already a hot-button issue for regulators. There are also potential antitrust concerns as search engines take on more responsibility for what information reaches consumers. And ads could be subtler and more subversive, which has already turned heads at the Federal Trade Commission (FTC).

For many, AI-assisted search feels like deja vu after the industry’s short infatuation with voice search, which never took off despite lots of hype in the late 2010s. There was no good way to monetize, so advertiser experimentation gave way to abandonment. It’s hard to make ads feel natural in any two-way conversation, whether typing or speaking.

But this time, the story will have a different ending. Search engines will figure out sustainable ways to monetize AI-assisted search, with ad-free subscription models not entirely out of the question. There’s simply too much money at stake—especially for Google.

AI-enabled search will likely reduce publisher site traffic, with major consequences for programmatic.

Chatbot interfaces for search engines are designed to answer complex user queries that would usually result in the user clicking on one or more links. Smaller monetizable audiences would be a huge problem for publishers and advertisers alike.

Publisher display revenues would decrease.

Publisher display revenues would decrease.

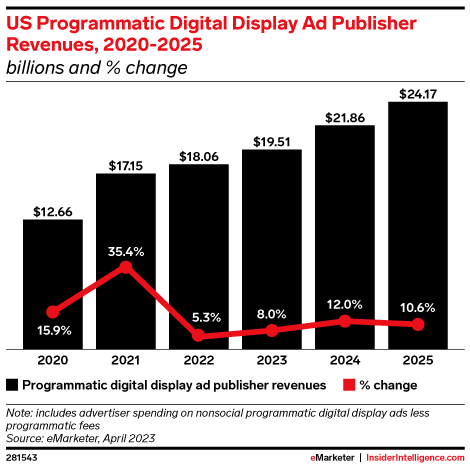

If publishers can’t rely on ad revenues to sustain their businesses, the quality of searchable content will suffer. Microsoft is considering a search revenue-sharing program, but it’s unlikely the tradeoff would be net neutral, which means at least some of the almost $20 billion we forecast US publishers will earn from programmatic advertising this year would be at risk.

Display ad costs would skyrocket.

Display ad costs would skyrocket.

It would become harder to reach audiences with programmatic media, especially on the open web. Add that to the deprecation of third-party cookies and mobile advertising IDs, which is causing an upheaval in the digital advertising ecosystem.

Despite the hype, consumers are dubious about AI-assisted search.

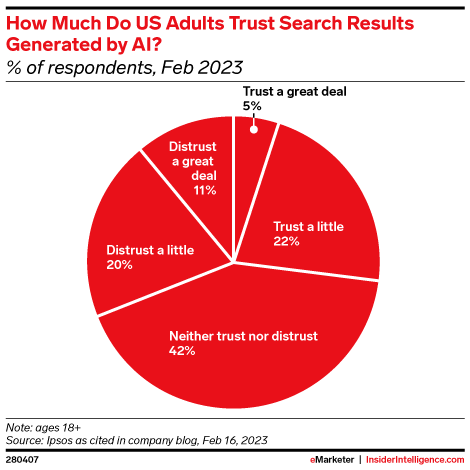

Almost half (49%) of US adults are interested in AI-powered online search, according to a February 2023 Morning Consult survey. But Ipsos found that only about a quarter (27%) trust search results generated by AI. There have been enough public blunders to justify any uneasiness.

Misinformation is a big concern.

Misinformation is a big concern.

More than two-thirds (68%) of US adults are worried about misinformation being included in results from search engines that use AI, per Morning Consult.

Consumers are also wary of search personalization.

Consumers are also wary of search personalization.

Personal data privacy is the top AI-related concern among US adults, cited by 74% of respondents to the Morning Consult survey. And distrust of AI-generated search results is even higher when those results are tailored to the user, according to Ipsos.

What’s the best course of action for search advertisers?

Stay skeptical.

Stay skeptical.

It’s important to keep an eye on the next big thing—and AI will be huge—but it’s too early to predict how search habits will evolve, let alone the best practices to drive conversions. AI-assisted search may even be better suited to awareness plays. A wait-and-see approach is advisable.

Stay agile.

Stay agile.

Until there’s more stability in both the tech and consumer behavior, it’ll be tough to craft smart search strategies around AI. But there’s a major opportunity afoot. Keep asking Microsoft and Google representatives the hard questions and be ready to pivot when they answer.

Key Takeaways

Key Takeaways