The DTC strategies driving brand growth and profitability, and the established brands beating DNVBs at their own game in terms of sales and scale.

Direct-to-consumer (D2C) ecommerce is evolving as brands adapt to achieve profitable growth amid increased competition. Many digital natives are learning what it takes to win enduring brand status, while others have found that the early D2C playbook is no longer an easy path to riches. As established brands lean into their own D2C strategies, the true keys to D2C success are now coming into view.

Key Takeaways

Key Takeaways

In the US, D2C ecommerce sales for established brands will reach $117.47 billion this year, more than three times larger than those of digitally native brands.

- D2C strategies can drive brand growth and profitability, but they are not without their challenges. Digitally native vertical brands (DNVBs) have used D2C strategies that cut out intermediaries and distribution partners to disrupt incumbents, but many have trouble scaling past a few million dollars in sales. Meanwhile, established brands adopting D2C strategies must execute this strategy shift while fending off the disruptors.

- D2C ecommerce is growing at above-average rates, but that’s not enough amid rapidly increasing costs. US D2C ecommerce sales will rise 21.3% year over year (YoY) to $155.69 billion this year, accounting for 15.1% of total ecommerce sales. Despite a large and growing market opportunity, many digitally native D2C brands are withering under the strain of rising costs related to the supply chain and digital advertising, making profits elusive—even for the best-known brands.

- Established brands are beating digital natives at their own game and account for most D2C sales. This year, established brands will account for 75.5% of the US D2C ecommerce market, and their sales will grow by 22.6% YoY to outpace the disruptor brands, at 17.5%.

- The “brand” aspect is more important than the “D2C” one. A successful D2C strategy requires putting consumers and brands first; scale and profitability will follow. Data-driven growth hacking only takes a brand’s revenue growth so far. Getting to scale means blending these practices with more traditional media and means of distribution.

D2C Ecommerce Opportunities

In February 2022, Foot Locker’s stock tumbled 35% upon news that Nike’s pullback as a retail partner would lead to drastic revenue and profit declines. Foot Locker was just the latest retailer domino to fall in Nike’s ongoing “consumer direct” strategy to sell more shoes and apparel through its owned and operated channels. What the brand sacrifices in sales through these distribution channels, it more than makes up for in higher margins from selling direct. The outlook for Nike’s future profits appears bright.

At the same time, dozens of DNVBs are struggling to scale and deliver profits at the levels once expected of these high-flying disruptor brands. Early D2C superstar Warby Parker went public in September 2021 with a growth strategy increasingly dependent on opening physical stores, after reporting a modest $393.7 million in annual revenues and a $55.9 million loss in 2020. Like many other public D2C companies, its stock price has been cut in half since its debut.

The D2C market can be delineated into two segments: DNVBs and established brands. DNVBs are brands started in 2010 or later that began by selling their products directly to consumers through ecommerce channels, often relying heavily on digital marketing. Established brands are the incumbents—the mass-market brands being disrupted by DNVBs—that are now adopting D2C strategies to improve their business fortunes.

Digitally Native D2C Brands Rose amid the New Media Value Chain

Digitally Native D2C Brands Rose amid the New Media Value Chain

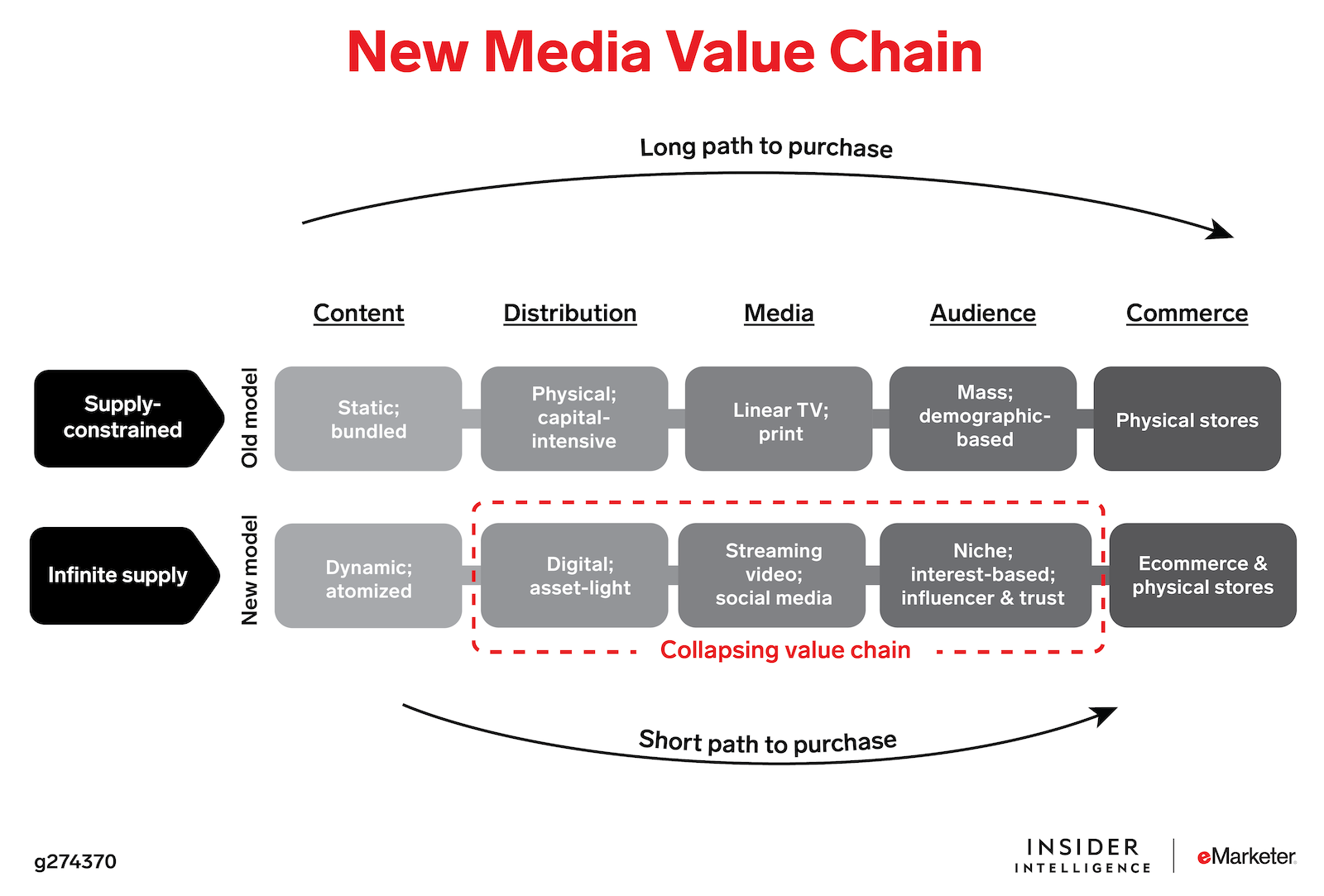

The traditional model of the media value chain relied on gatekeepers for distribution—media channels like print and cable bundles to reach audiences, and physical stores for sales.

The new media value chain, by contrast, enables brands to bypass traditional gatekeepers, find customers, and drive sales through purely digital mechanisms. Even with modest marketing budgets, brands can target niche audiences of prospective customers with digital ads to drive ecommerce sales. These low barriers paved the way for digitally native D2C brands.

D2C brands pioneered the marketing playbook for this new reality—predicated on cutting out the middleman wherever possible. They went directly to suppliers to develop new products that address unmet customer needs, wrapped those products in fresh branding and design, advertised to highly targeted digital audiences, and drove sales directly through owned and operated websites.

The new media value chain—with the upside of drastically shortening the path to purchase—has required a fresh set of skills for brands to master. But in a fragmented ecosystem characterized by a near-infinite supply of media, an endless digital aisle, and minimal barriers to entry, it can be hard to stand out. By solving for these modern marketing challenges, the D2C playbook offers lessons that every brand today ought to internalize.

D2C brands went “over the top” of entrenched gatekeepers to get off the ground. From Dollar Shave Club’s seminal viral video commercial to ThirdLove’s full-page ad attacking Victoria’s Secret in The New York Times, brands effective at creating earned media opportunities—and amplifying their message on social media—can grab a foothold in their respective categories.

Influencers are central to D2C brand strategy, precisely because they break through in a fragmented digital media landscape. These personalities prove their value by cultivating audiences—and their attention—on social media. A more current, expansive view of an influencer should include any trusted personality—not just those on social media—that can cut through the clutter while credibly conveying the brand ethos. This can mean official brand ambassadors, a la Peloton instructors, or celebrities intertwined with the brand, like Kylie Jenner of Kylie Cosmetics.

D2C Ecommerce Sales Show Steady Growth

D2C Ecommerce Sales Show Steady Growth

As this wave of new products and brands has popped up in people’s social media feeds, consumers have responded.

US D2C ecommerce sales have more than tripled in the past six years. The market has grown from $36.08 billion in 2016 to $128.33 billion in 2021—a gain approaching $100 billion in about half a decade. We expect it will add almost another $100 billion in the next three years, reaching $212.90 billion by the end of 2024.

D2C sales will account for 1 in 7 ecommerce dollars this year. That’s solid evidence that consumers are well accustomed to buying directly from brand websites.

Established brands—and not DNVBs—will drive the vast majority of D2C ecommerce sales. Although DNVBs grab the headlines, established brands will account for 75.5% of US D2C ecommerce sales in 2022.

D2C ecommerce sales of established brands are now growing faster than those of DNVBs. Last year, they outpaced DNVB growth (27.2% versus 19.8%), and we expect that trend to continue in 2022.

As the D2C Ecommerce Market Matures, It’s Growing More Competitive

As the D2C Ecommerce Market Matures, It’s Growing More Competitive

The D2C market still largely exists in the long tail. Most (75.1%) of the D2C merchants in the US were smaller players in the long tail of the market with less than $5 million in web sales, according to an August–October 2021 analysis from PipeCandy. Another 22.5% had between $5 million and $50 million in web sales, and just 2.5% had more than $50 million. Low barriers to entry mean many brands can participate, but few can expect to reach scale.

DNVBs skew heavily toward fashion and apparel. The same PipeCandy study found that 67.7% of D2C brands were in the fashion and apparel category, with food and beverages a distant No. 2 at 8.1%. High category concentration also fuels more competition.

Top DNVBs are seeing traffic growth moderate. Among the top 25 D2C brands by web traffic worldwide, total visits grew by 24% to 2.71 billion in 2021, according to SimilarWeb. But that figure would fall to just 7% if OpenSea, a trading platform for nonfungible tokens (NFTs), were excluded from the list.

Key Players in D2C Ecommerce

DNVBs

DNVBs

Several of the best-known digitally native D2C brands are encountering growing pains on their paths to maturity. With billion-dollar valuations and public stock offerings comes investor scrutiny that’s caused even the highest-regarded brands to wither under the spotlight.

The most well-known D2C brands have seen ecommerce momentum stall. Global traffic growth at five of the top DNVBs moderated following the boom in 2020, SimilarWeb data illustrates.

Several of the DNVBs most often associated with the D2C trend have succeeded in creating durable, category-defining brands. But even they must now explore new avenues to growth—most notably, physical retail—to fulfill their ambitions.

- Warby Parker. This eyewear brand captured the early-millennial hipster ethos, solved the pervasive problem of (monopoly-driven) overpriced glasses, and innovated over-the-top distribution with its home try-on program. It used a strong narrative and earned media strategy to break through and capture the zeitgeist. But its recent debut on the public markets has underwhelmed: The brand hasn’t experienced hypergrowth and largely depends on physical stores to continue scaling.

- Dollar Shave Club. This may be the original D2C brand, first breaking through in 2012 with founder Michael Dubin’s hilarious viral video commercial, titled “Our Blades Are F***ing Great.” Eventually acquired by Unilever for $1 billion in 2016, Dollar Shave Club is today struggling to find growth. On Unilever’s Q4 2021 earnings call, CEO Alan Jope acknowledged that the economics of the D2C model had changed, and that Dollar Shave Club was having trouble expanding product sales beyond razors. It has attempted to get onto physical store shelves at mass merchandise retailers but trails competitor Harry’s, a fast-follower D2C razor brand, in that regard.

- Casper. One of the early D2C winners, Casper built a consumer-friendly brand around the value of sleep—in stark contrast to companies like Mattress Firm and American Mattress. Casper’s short time on the public markets was a disaster, as the company saw growth stall while hemorrhaging on the bottom line. In November 2021, the company announced its acquisition by a private equity firm.

- Peloton. The connected fitness brand has experienced whiplash since the onset of the pandemic. The early period of stay-at-home orders accelerated demand for its pricy stationary bikes and drove 120.3% revenue growth in its fiscal year 2021 (July 1, 2020, through June 30, 2021). But the two most recent quarters saw revenue growth plummet to 6% amid growing competition, supply chain disruptions, and public relations issues. The high-flying brand, once valued at nearly $50 billion, is now a potential acquisition target for the likes of Amazon, Apple, or Google at a valuation under $10 billion.

- Allbirds. The D2C casual footwear and apparel brand, known for its trendy wool sneakers, debuted on the public markets in November 2021, touting category and physical store expansion as key avenues for growth. Investors have already grown weary, however, with the stock trading at less than half its IPO price. Amid underwhelming earnings and 2022 guidance, the brand is now pursuing a wholesale strategy to recharge top-line growth.

Established Brands

Established Brands

While DNVBs encounter the brutal reality of public markets and investors’ demands for growth, a growing crop of established brands are advancing their D2C ambitions.

- Nike. The iconic global footwear and apparel brand epitomizes the successful D2C strategy for established brands. Over the past decade, Nike has invested in cutting-edge channels it owns and operates—both online and via physical stores—while systematically pruning its distribution partners. Nike is taking more complete ownership of its brand while amplifying its direct relationship with customers.

- Lululemon athletica. The athleisure category’s earliest incarnation, lululemon had the characteristics of a D2C brand that remain foundational to the brand itself. Today, its strategy banks on D2C media experiences that leverage the lululemon app and recently acquired Mirror, a smart home gym system. Most recently, the brand expanded into the lucrative footwear category to rave reviews, opening up the possibility of a major new incremental revenue stream.

- Tesla. The high-profile electric vehicle company has pioneered D2C in the automotive category, going over the top of auto dealerships with owned and operated showrooms while bringing the buying process online. Unlike other auto brands, Tesla doesn’t advertise, relying mostly on positive word-of-mouth and the “over the top” personality of visionary CEO Elon Musk to capture attention. In bypassing intermediaries to build its brand, Tesla has helped keep costs in check while reinvesting profits in research and development (R&D).

- Adidas. Adidas plans for D2C sales to account for 50% of its revenues by 2025. The brand is among the most popular on social media and has used one of the biggest influencers around—Kanye West—to stay on the leading edge of pop culture and break through the noise. In a move highlighting its understanding of modern-day brand ambassadorship, adidas announced an innovative name, image, and likeness (NIL) network for Division I college athletes. The athletes can leverage their social media channels to promote the adidas brand and products while earning a cut of attributed sales.

- Crocs. Perhaps the dark horse of this group, Crocs saw D2C sales make up nearly 50% of its $2.3 billion in total revenues in 2021. The brand is aggressively pursuing its D2C strategy: It has recently taken steps to protect its distinctive design from copycats, cut ties with retail distribution partners, and leaned into influencer marketing, using both celebrities and micro-influencers as brand ambassadors. Crocs has recently extended its casual footwear into sandals, promising its next avenue for growth.

Ecommerce and Social Media Platforms

Ecommerce and Social Media Platforms

The rise of DNVBs is due in large part to the democratizing force of ecommerce enablement platforms like Shopify and social media platforms like Facebook and Instagram.

Shopify is the dominant enablement platform among digitally native D2C brands. In fact, 65.4% of D2C brands in the US used Shopify (including 7.6% on Shopify Plus, its enterprise-level offering), according to PipeCandy’s analysis. WooCommerce, BigCommerce, and Magento also play a key role in facilitating brands’ ability to sell online with out-of-the-box solutions for things like site hosting, product content, checkout, and fulfillment.

Facebook and Instagram remain the top channels for D2C marketing. Social media is the primary channel upon which most consumers will first encounter the brand. Among US D2C brands of all sizes with a social media presence, more than 90% were on Facebook and Instagram, per PipeCandy. Their presence on Twitter, Pinterest, and YouTube was more varied.

The D2C Model

Disintermediating the Value Chain to Drive Profits

Disintermediating the Value Chain to Drive Profits

Built on a foundation of data, the D2C playbook identifies principles to tap unrealized value for consumers and brands alike:

- Develop a brand with a modern twist on an old product. Identify a customer need that is currently unmet by the industry incumbents. Create a product to meet that need, wrap it in modern branding, and position the brand around that need.

- Cut out the middlemen on product and distribution. Go directly to product manufacturers to source cheaper product. Then, sell that product online without retailer markup.

- Provide a quality product at an attractive price. Pass along the savings to the consumer, creating a perception of value.

- Reach audiences hyperefficiently through targeted ads. Use highly measurable digital ads—particularly search and social—to reach only those audiences most likely to purchase from the brand.

- Use data to measure and optimize marketing spend. Leverage the tight feedback loops of data-driven performance advertising to scale up ad spend with audiences that convert.

The Challenge of the D2C Model

The Challenge of the D2C Model

For both DNVBs and established brands, the objective shouldn’t be about building a D2C brand, but rather about building a brand that can go D2C.

The natural lifecycle of D2C brands is to go straight to consumers to get off the ground, become wholesale brands in order to achieve scale, and then revert to D2C sales channels to the extent their brand equity allows.

The fundamental challenge for DNVBs is to grow from their disruptor beginnings into mature, mainstream growth brands that can scale. Meanwhile, for established brands, the challenge is to evolve into the digital-first era, using first-party data to innovate and iterate quickly, fueling their ability to sell more via D2C channels.

Potential Revenues and Costs

Potential Revenues and Costs

DNVBs can build and grow a billion-dollar brand—capable of acquisition or IPO—in five to 10 years’ time. This path to growth simply wasn’t as feasible in a world where brands were fully dependent on the retailer. The downside is that without the built-in scale of mass retailers, DNVBs need to work harder to create awareness and drive traffic to their sites. These costs can be expensive, if not prohibitive.

There are limits to the D2C maxim “CAC is the new rent.” The early wave of D2C brands viewed customer acquisition costs (CAC)—predominantly digital advertising expenses—as a more cost-effective substitute for paying physical store rents. However, as those costs rise and growth becomes harder, a new refrain has emerged among industry observers: “CAC isn’t the new rent. Rent is the new CAC.”

Established brands can regain control of their merchandising and take back margin from retailers. A D2C strategy can help stave off brand dilution from poorly merchandised retail locations while recapturing the retailer’s markup. But deliberate pruning of retail distribution channels makes brands less available to consumers and can weigh on revenue growth.

Trends that Are Disrupting D2C Ecommerce

The D2C brand movement began with the disruptors taking on incumbent brands in their respective categories. But with incumbents fighting back while the industry landscape shifts beneath their feet, the disruptors are becoming the disrupted.

The way to outsmart—for both DNVBs and established brands—is to respond and adapt to changing conditions.

Consumer Behavior Changes

Consumer Behavior Changes

Disruptor brands can exploit the evolution in various consumer trends—many of which are generational shifts that have been accelerated by the pandemic.

- Changing consumer preferences. Current leading issues among consumers include sustainability and diversity, equity, and inclusion (DEI), as well as mental health and wellness, better-for-you indulgences, pet ownership, and remote work, among others. This has helped fuel the rise of brands like Rothy’s (shoes made with recycled materials), Blk & Bold (Black-owned coffee brand), Gravity Blanket (anxiety-reducing comfort), Magic Spoon (keto-friendly “kids’” cereals), Haus (low-alcohol cocktails), BarkBox (pet toys), and Bloomscape (indoor plants).

- Evolution in consumer brand ethos. Brands can also find a wedge by aligning with evolving consumer brand affinities. Many DNVBs have tapped into the underdog zeitgeist by punching up against the industry incumbent, like Dollar Shave Club attacking Gillette on price and Dr. Squatch sideswiping “Big Soap” for its use of synthetic detergents. Other D2C brands like Warby Parker and Allbirds have leaned into their statuses as public benefit corporations (PBCs) and B Corporations, proving that companies can balance profit and purpose.

- The ecommerce boom. The pandemic acceleration in ecommerce growth has permanently tipped the trajectory upward, creating a bigger market from which to carve out a slice. We forecast that US ecommerce sales will surpass $1 trillion for the first time this year, almost doubling from 2018.

- The rise of social commerce—and TikTok’s role in it. We forecast that US social commerce will rise 24.9% to $45.74 billion this year, representing 4.4% of total ecommerce sales. The ongoing shift to social media channels for both product discovery and purchase offers a growing opportunity for brands. TikTok’s meteoric ascent and growing social commerce ambitions could accelerate its trajectory while shifting the power balance among leading channels.

Business Disruption

Business Disruption

Several disruptions to the retail product, media, and marketing supply chain are adding cost and volatility to the D2C business model.

- Apple iOS 14.5 tracking changes. Apple’s AppTrackingTransparency (ATT) initiative—the effects of which began mid-2021—made it hard for D2C brands to target their best audiences and know whether their ads were working. Meta and other social media companies were hit hard, resulting in a sizable loss of D2C budgets. Facebook’s share of US D2C ad spending declined from 34.9% in January–March 2021 to 27.0% a year later, according to a Rockerbox report.

- Rising ad costs. This is making it expensive to acquire new customers and crimping profitability. In Q4 2021, search ad prices were up 23% YoY, social ads were up 22%, and retail media ads were up 13%, according to global data from Skai.

- Higher supply chain costs. These are compounded by inventory constraints stemming from global supply chain issues. D2C apparel brands, in particular, have suffered from delays that result in lost sales due to out-of-stocks and inventory that’s misaligned to the season.

Implications for Marketers: How to Build Breakthrough Brands in the Digital Age

Building breakthrough brands with staying power in the digital age will combine the best aspects of traditional mass-market branding and a modern growth-hacking mindset. Established brands and DNVBs must be willing to learn from one another.

What Can Established Brands Learn From DNVBs?

What Can Established Brands Learn From DNVBs?

Recent improvement in established brands’ D2C fortunes signals they are beginning to integrate the successful strategies of their plucky DNVB competitors.

- Use intuition—supported by first-party data—to address evolving customer needs. D2C brands love to talk about data, but most breakthroughs have relied on intuition about the needs of modern consumers. Away’s realization about millennial travel habits, which favored traveling light and in style without mobile-phone charging anxiety, led to its signature luggage. Quip recognized that consumers wanted an electric toothbrush that was easy to grip and wasn’t an eyesore. Both brands may use first-party data for continued innovation, but data didn’t fuel these foundational consumer insights.

- Treat customer experience as a loyalty driver, not a cost center. The D2C movement popularized the LTV-CAC ratio—customer lifetime value (LTV) over CAC—which made long-term recurring revenues intrinsic to D2C marketing. When brands optimize for short-term financial success, they squeeze costs from things like customer service at the expense of LTV. DNVBs internalized the value of remarkable customer experience (e.g., website user experience, easy checkout, delightful packaging, post-purchase communication, convenient returns) in a way that established brands typically have not.

- Iterate quickly on product cycle development and marketing optimizations. Product R&D and innovation cycles at large established brands have often followed multiyear cycles and often don’t produce what the customer needs or wants. This is what gave us an ever-expanding number of blades on a razor at an ever-expanding price point, leaving Gillette susceptible to an upstart like Dollar Shave Club. Staying current with consumer trends, understanding the features they need—and don’t need—and getting new products out to market fast will make customers feel seen.

- Leverage influencers to get traction on digital media channels. DNVBs’ use of influencers to create brand affinity and drive sales has been an effective growth hack. Aggregating the reach of niche media vehicles functions as a modern corollary to mass-reach vehicles of yesterday: Their impact depends on authenticity that isn’t easily manufactured. When a celebrity is inextricably linked to the brand—as Jessica Alba is to The Honest Company and Rihanna, to Savage X Fenty—the brand is tailor-made to break through on social media.

Implications for Marketers: How to Build Breakthrough Brands in the Digital Age

Implications for Marketers: How to Build Breakthrough Brands in the Digital Age

Amid their current reckoning, digital natives are now coming to appreciate some of the time-tested approaches to building a mass consumer brand.

- Cultivate the distinctiveness and differentiation of your brand. So many DNVBs now feel like a cliche: sans serif font, similar color schemes, a “problem meets solution” origin story, underdog mentality, and promotion of ethically and sustainably sourced products. At this stage, the disruptors en masse have created a new status quo. The ability to differentiate going forward requires doubling down on truly distinctive brand assets. Though Nike is constantly evolving, time-tested hallmarks of its brand—from the swoosh logo to the orange shoebox to the “Just Do It” tagline—haven’t changed.

- Invest in brand-building advertising. DNVBs’ early sales growth rates led them to rely on a playbook that undervalued the importance of traditional—and often poorly quantifiable—brand advertising. Brands that want to create cultural resonance need to cast a wider net, diversify beyond data-driven digital ads, and accept that not every dollar of marketing spend will be perfectly measurable. Peloton, Chewy, and Carvana are among the top DNVBs to internalize this lesson, according to iSpot.tv’s 2021 TV ad impression data.

- Leverage physical retail to gain distribution. Consumers usually choose the path of least resistance in purchasing products. For most brands and categories, that means meeting consumers where they are—and for more than 80% of retail purchases, that’s inside the store. In fact, several of the top reasons that US consumers choose traditional brands over DNVBs come down to product availability, according to an October 2021 Diffusion study. DNVBs that never make the leap to physical distribution necessarily limit their growth potential.

Building Breakthrough Brands in the Digital Age

Building Breakthrough Brands in the Digital Age

As marketers look to build growing and profitable brands adapted to the realities of the digital age, they should prioritize the following strategies:

- Make your brand assets distinctive. Too many DNVBs tried to reflect millennial and Gen Z consumer trends and failed to stand out as a result. Established brands—even those that could use a refresh—maintain recognizable colors, fonts, logos, and taglines and are unmistakable to consumers. “Visual differentiation is a very important piece, especially on the digital shelf—nobody wants to get lost in the sea of same,” said Jehan Hamedi, founder and CEO of Vizit. “Focus on identifying images that are going to work harder than your competitors.” There is no universal best practice for what resonates, but using a distinctive color palette and high-contrast imagery can create thumb-stopping content.

- Leverage authentic brand ambassadors to carry your brand message and communicate a clear point of view. Personality can breathe life into a brand, but only when that personality is authentically aligned. Nike’s embrace of Colin Kaepernick following his de facto blacklisting from the NFL was unapologetic in its support of Black Lives Matter. The brand’s willingness to take a stand on a politically charged issue made clear what it stood for. Brands don’t need to jump on every social issue, but they also shouldn’t shy away from standing up for their values. Communicating a brand’s core ideology through individual narratives with an articulated point of view will speak volumes.

- Use digital ads—particularly CTV—to drive branding and performance. Creating distinctive assets, a well-honed message, and breakthrough content for digital ad campaigns can achieve both branding and performance simultaneously. Brands should leverage performance data to drive positive ROI, but without overoptimizing and targeting too narrowly. Connected TV (CTV) is a unique, emerging ad medium that blends the best of both worlds and scales up to cast a wider net. “When brands can’t scale on Facebook, they go to linear TV and OTT,” said Sara Livingston, head of customer solutions at Rockerbox. “Nobody that knows better is trying to shove OTT into the same box as Facebook. … They’re not running addressable [ad buys]; they’re all running demographic and interest-based buys.”

- Use traditional media and physical stores to establish cultural awareness. Brand equity stems not only from a brand’s consumption value, but from its signaling value—when a consumer knows that everyone else recognizes the value of that brand. Common cultural touchstones like highly rated TV programming, out-of-home advertising, and physical stores create that effect in a way that targeted digital ads simply can’t. Brands shouldn’t ignore the importance of cultural awareness as they look to scale.

- Use digital channels to create loyalty and engagement that drive LTV. Peloton’s most valuable brand-building asset is interactive digital content. This is the tether that creates community, cultivates daily engagement, and exposes users to instructors—key brand ambassadors who also happen to wear Peloton-branded apparel. Customers ultimately pay extra for what amounts to a brilliant upsell channel for Peloton. “There’s less of a financial commitment with our digital-only subscription, and with those members we are able to build a wider pool of leads,” said Robert Franklin, senior vice president of ecommerce at Peloton Interactive, Inc. “It is one of our top sources of bringing new members into buying a bike or a treadmill, and then joining and upgrading to the all-access membership.” Other digital content includes games for consumer goods brands (e.g., M&M’s Adventure), lifestyle blogs (e.g., Into The Gloss from Glossier), and online magazines (e.g., Here, a travel and lifestyle digest from Away).

- Develop category mastery before expanding the brand. There are few shortcuts to building a brand, and the ability to extend into new categories where the brand hasn’t yet established credibility is fraught with risk. While Casper attempted to take on an entire category of sleep, it failed to protect its flank from cost overruns and competition from other D2C mattress brands. Conversely, lululemon is credibly moving into the footwear category—already laced with strong competition—precisely because there is trust and goodwill in the brand.

- Be data-informed, rather than data-driven, to drive growth. D2C’s data-first orientation hasn’t always taken brands as far as they want to go. That’s because data-driven insights are constrained by what’s being measured, and optimizations primarily extract value rather than create value. Instead, brands must get comfortable betting on things that can’t be easily measured—whether that’s using intuition in the product development cycle, widening the circle of target customer segments to see who responds, or putting more faith in brand advertising that may not generate immediate sales.

Key Takeaways

Key Takeaways