The latest AI startup trends, notable marketing and retail startups, and strategies for successfully engaging AI to drive innovation and value.

Key Takeaways

Key Takeaways

Venture capital (VC) investment may be experiencing a downturn in the current tech market correction, but last year’s record-breaking investments are starting to pan out. Brands and tech players need to keep an eye on which startups have made the most progress and which still have a long runway with solid survival strategies. By collaborating with the right tech-native startups, marketers and retailers can fill in gaps and accelerate their own strategic goals.

Global investment in AI startups has slowed in H1 2022, after reaching a record-setting $51.29 billion last year in the US alone. But startups driving marketing and retail innovation are still poised for success.

- VC funding is slowing, including investment in AI startups. Global investment in AI companies increased by 115% in 2021 over 2020, thanks to promising new applications accelerated by the pandemic and the market reactions that followed. But Q1 2022 experienced a 32% drop in exits—the third consecutive quarter-over-quarter drop—as the public market pulled back across the broader venture market.

- Brands should pay attention to AI startups focused on marketing and retail applications—but be aware of risks. Companies building tech infrastructure, platforms, and usable tools (e.g., applications) will make strides this year as use cases mature.

- Take a strategic approach to engage startups and implement AI, considering not only tech needs but also cultural fit and alignment. Best practices for implementing AI are constantly adapting as technology and use cases evolve.

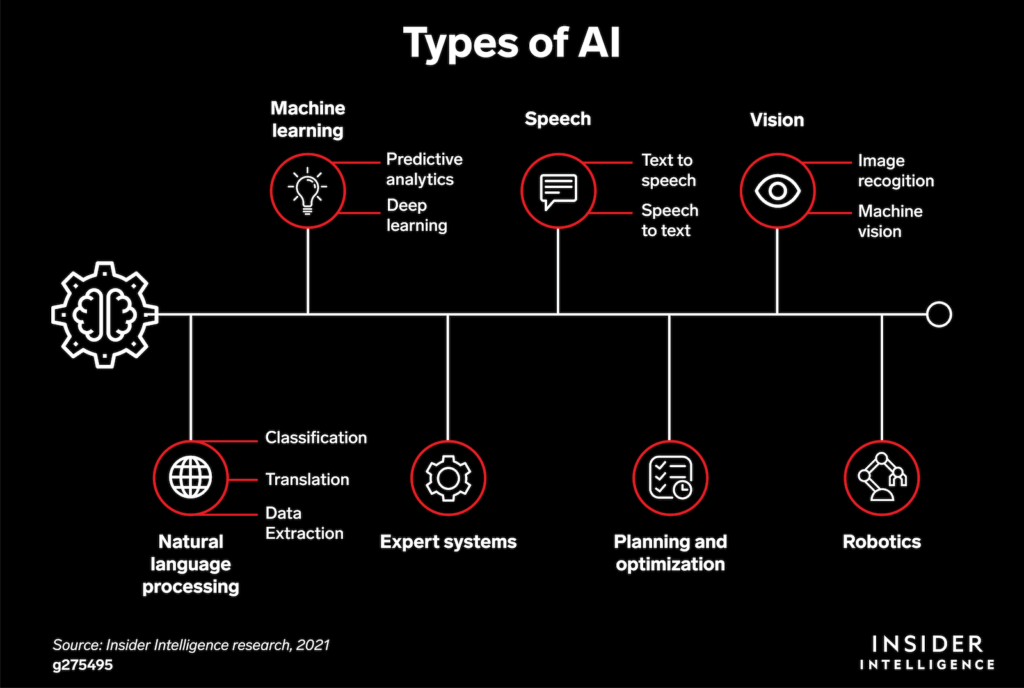

What is AI?

AI is an umbrella term. The subsections relevant to this report are the following:

Machine learning (ML). A branch of AI and method by which computer systems learn, analyze, and interpret data to take actions on their own without programming.

Natural language processing (NLP). A branch of AI that enables computers to understand, interpret, and respond to human language. Includes subsets like natural language generation and natural language understanding, with applications in both text-based and voice-based interpretation.

Predictive analytics. Uses ML techniques and statistical modeling to identify the likelihood of future outcomes based on historical data.

Advanced analytics. Uses ML in combination with other sophisticated techniques and tools (e.g., visualization techniques) to identify deep insights.

AI Transformation

AI Is Transforming Brand-Customer Relationships in Marketing and Retail—but Not Without Risk

AI Is Transforming Brand-Customer Relationships in Marketing and Retail—but Not Without Risk

To remain at the forefront of disruption, brands must interact with startups that are developing technologies to challenge legacy marketing and retail practices. Taking the right strategic approach, brands can apply AI to transform customer interactions, resolve pain points faster, and communicate with customers in more diversified ways, among other possibilities.

In Q1 2022, global funding in AI startups declined by 12% from the previous quarter to $15.1 billion, according to a recent CB Insights report. Despite the drop, Q1 was still the fifth-best quarter ever for AI funding and second-best for total deal count.

The Q2 2022 plunge in tech stock prices, ongoing fall in VC funding, and increase in tech layoffs will undoubtedly put even more pressure on startups. Some may fold. But most of the companies discussed below have sufficient cash and runway to implement plans and launch products.

The shortage of VC funding may provide opportunities for legacy brands to get in on startups early and make their own investments.

Two investment trends are emerging in AI funding, according to Erin Price-Wright, a partner at Index Ventures:

![]() Horizontal tooling and platforms that solve parts of the ML lifecycle and learning problems across many use cases.

Horizontal tooling and platforms that solve parts of the ML lifecycle and learning problems across many use cases.

![]() Verticalization of ML tools that manage end-to-end workflow, addressing business or operational concern.

Verticalization of ML tools that manage end-to-end workflow, addressing business or operational concern.

Brands Will Continue to Value Startups’ Big Ideas

Brands Will Continue to Value Startups’ Big Ideas

Big companies are increasingly interested in startups. New corporate venture operations reached 221 in 2021, up from a six-year low of 144 in 2020. Companies now realize that startups are defining the future of industries, and that they must interact more to stay at the forefront of innovation.

Forward-thinking brands are exploring innovation in new ways. They understand that internal investment and mergers and acquisitions (M&A) aren’t enough to drive growth in today’s economy. More and more brands are exploring corporate ventures and becoming early customers of startups.

- Adobe, for example, generated an additional $10.8 million in revenues by partnering with Drift, a conversational AI startup, to deploy a chatbot that helps customers engage with website content.

- Big ideas come from startups—especially in AI, where they often spin out of leading research labs. Marketing and retail players will succeed in implementing AI when they pay attention to the application innovation happening at startups.

AI’s Expanding Value Proposition Extends Beyond Tech Companies

Almost three-quarters of companies are now using or exploring the use of AI. Over a third (35%) of companies have deployed AI, and 42% are considering it, according to IBM’s “Global AI Adoption Index 2022,” conducted in partnership with Morning Consult. More companies are beginning to utilize AI tools or machine learning algorithms in their internal processes and products.

Applications for non-tech businesses are only growing, as tools like dynamic content—which changes based on personalized insights—and chatbots become more popular. McDonald’s, for instance, has experimented with NLP in its drive-thrus to automate the ordering process.

Companies are realizing the value of AI startups as an alternative to building capabilities in-house. Non-AI companies can gain access to specialized talent and build customer loyalty, which gives them the opportunity to shape products based on their specific needs. Large brands are becoming more comfortable as early customers of startups—because they’re seeing the benefits.

Marketing and Retail AI Applications Are Paying Off for Brands

Marketing and Retail AI Applications Are Paying Off for Brands

AI applications are becoming more common across functions including supply chain, product, and back office. Brands are using AI tools to generate deep customer insights, track supplier pricing, and more.

And it’s making a difference. More than 80% of IT professionals in marketing and sales worldwide believed AI led to a reduction in costs, with more than a quarter (27%) reporting a decrease of 20% or more, per a June 2021 survey by McKinsey & Company.

Many marketers already implement AI without knowing it—using certain email automation workflows or generating keywords, for example. In other words, they’re using AI to help complete tasks.

Close to half (46%) of financial services marketing leaders in France, Italy, the UK, and the US believe marketing AI investments can lead to a revenue lift of 30% to 69%, according to a January 2021 survey by Persado.

The key to driving revenues and decreasing cost with AI lies in a strategic, integrated approach—for example, implementing tools that generate cross-platform insights alongside those that provide product recommendations and handle programmatic buying.

- Marketing, among all company functions, has the most to gain from AI, according to Harvard Business Review, with applications like improving the accuracy of sales forecasts and ad targeting.

- Three of the top five AI objectives are marketing-oriented, according to a global 2020 Deloitte survey of early adopters:

![]() Enhancing existing products and services

Enhancing existing products and services

![]() Creating new products and services

Creating new products and services

![]() Improving relationships with customers

Improving relationships with customers

Consumer experience-related applications like content personalization continue to gain popularity. Predictive analytics can also be a great tool for gathering insights into customer behavior patterns. Starbucks, for example, uses predictive analytics to collect and analyze customer data from loyalty cards and its app.

Among retail marketing leaders in France, Italy, the UK, and the US, 58% plan to use AI for analytics, and 42% will use it for consumer insights, according to Persado.

Marketing professionals also find AI and ML useful in email marketing campaigns, particularly for send-time optimization and personalization, segmentation, and targeting, according to a July 2021 global survey by Litmus.

Customer service remains one of the most popular applications for AI tools in non-AI companies. Conversational technologies like voice assistants and chatbots to manage customer interactions bring immediate value to companies and streamline otherwise time-constraining processes.

![]()

“We used to say ‘mobile first,’ and I think now it’s going to be ‘conversational AI first.’ The trend is going to consume current applications, like customer experience and marketing, and new applications, like the metaverse, in the future.”

— Raj Koneru, CEO and founder, kore.ai

In retail, AI applications can help brands reach strategic goals, such as providing the customer a seamless online and offline experience through omnichannel fulfillment and “smart” store digitalization.

AI can help in physical stores—by automating checkout and loss prevention measures, for instance. Startups are on the frontline of these technology developments.

AI also has B2B applications. AI tools can help B2B sales and marketing leaders more efficiently perform processes like prospecting and targeting. In fact, B2B marketers in the US are using AI to optimize ad and conversion funnels and retargeting programs, as well as to measure specific KPIs, according to a February 2021 survey by Ascend2.

Conversational tools also have a big impact in the B2B space. Benefits of these tools include the ability to qualify customers in real time, increase sales productivity, and improve efficiency of ticket support, according to a July 2021 survey by Drift and Heinz Marketing.

Regulatory Attention, Risks, and Competition Intensify as AI Industry Grows

Regulatory Attention, Risks, and Competition Intensify as AI Industry Grows

Regulation of AI is inevitable and will affect all players—from startups to large corporations. AI regulation may gain legislative momentum in 2022: The US Department of Commerce has taken several steps in the regulatory direction, including the creation of the National Artificial Intelligence Advisory Committee (NAIAC). But even as lawmakers may engage in more discussions this year, Deloitte predicts that any potential laws will not be enforced until 2023 or later.

In the absence of regulation, companies will try to mitigate risks by self-regulating the use and transparency of AI tools.

Competition with China will create both risk and opportunity for US companies in the next few years. On the risk side, Chinese startups will push to outperform the US. On the opportunity side, federal funding toward AI research and startups will subsequently increase.

Companies may also face stigma from consumers if they fail to address how they’re implementing AI ethically and responsibly. Consumer wariness of bias in the technology will only grow. These worries now also apply to companies using third-party AI tools. Companies interacting with AI startups must institute responsible AI policies and assess their risk regularly via independent evaluations or certifications to detect and correct bias.

Will the AI Hype Cycle Get Real in 2022?

Despite pullback in funding and exits during the first quarter of 2022, AI startups still have a fair chance—thanks to the accelerating convergence of technical breakthroughs, leadership buy-in, and deployment across different business functions. The pandemic has driven a lasting surge of government and investor interest in AI, as its ability to help the world go remote has been tested.

VC Investment Is Pulling Back, but a Correction Does Not Spell the End for AI Startups

VC Investment Is Pulling Back, but a Correction Does Not Spell the End for AI Startups

While 2021 saw record levels of growth, later-stage valuations are now getting slashed, and startups are beginning to have layoffs. Optimism in the market might begin to fade as reality—i.e., real value, interest rates, and inflation—catches up with investment trends into H2 2022.

What Are the Make-or-Break Factors for Startup Success?

What Are the Make-or-Break Factors for Startup Success?

Without comprehensive leadership support, access to data, and effective scaling, AI projects are likely to fail—whether undertaken in a startup environment or at an established brand. But for a startup lacking the runway and room for error that might exist at a larger organization, these problems are only magnified.

Even if the project is completed, there are roadblocks ahead: It’s not always possible to predict how a model will behave in practice. Due to the effects of bias within data, algorithms, and the people in charge, 85% of AI projects will deliver outcomes different from the original project intentions, per a forecast by Gartner.

Startup success depends upon the following components:

- Founding team

- Product market fit

- Scalability

- Loyal early customers

- Constant redefining of business model

- Competitive intellectual property

The Most Promising Marketing and Retail AI Startups of 2022

These are the companies pushing forward AI applications in marketing and retail by innovating platforms and usability—so that more brands and individual users can harness the benefits of AI and ML.

Criteria for selection include the following, including companies of different sizes and stages to demonstrate the diversity of companies across the marketplace.

- Applications most interesting to marketing and retail professionals

- Personalization of marketing activities, consumer insights, and automations

- Enablement of new channels and interactions

- Money raised

- Founders’ past activity

- Current board members

- Notable customers

- Relevance to our readers’ interests and functions

Personalization

Personalization

Persado

Persado

Founders: Alex Vratskides, Assaf Baciu, Guy Krief

Application: Personalization

Headquarters: New York

Founded: 2012

Stage: Series C

Total funding: $66 million

Notable investors: Bain Capital Ventures, Citi Ventures, Goldman Sachs, StarVest Partners, Omega Venture Partners, American Express

What it does: Delivers an AI-generated language platform that can create content and decipher what will best resonate with specific customers through its algorithm.

Why this matters: Content-generation technology enables marketers to personalize content for specific customer segments, which can lead to higher engagement. The tool can help marketers target customers in a more meaningful way and drive better campaign results.

GumGum

GumGum

Founder: Ari Mir, Ophir Tanz

Application: Personalization

Headquarters: Santa Monica, California

Founded: 2008

Stage: Series E

Total funding: $133.8 million

Notable investors: Upfront Ventures, NewView Capital, Morgan Stanley Expansion Capital, Goldman Sachs

What it does: Uses AI to draw value from digital content, using contextual information to place ads where they can be most effective. Personalizes ad placement, provides dynamic ad creatives, and measures attention for real-time optimization.

Why this matters: Dynamic content and personalized ad placement are important tools for staying up to date on ways to reach consumers. The company provides an AI-driven method to optimize campaigns and understand where and how consumers want to see ads.

Insights

Insights

Fiddler AI

Fiddler AI

Founders: Krishna Gade, Amit Paka, Manoj Cheenath

Application: Insights

Headquarters: Palo Alto, California

Founded: 2018

Stage: Series B

Total funding: $45.2 million

Notable investors: Lux Capital, Lockheed Martin Ventures, Lightspeed Venture Partners, Insight Partners, Haystack, Bloomberg Beta, Amazon Alexa Fund

What it does: ML performance monitoring platform that uses AI to validate, explain, monitor, and analyze algorithms for biases or other distortions. Key applications include applying insights to reduce churn—by evaluating why customer interaction with a company stops and how to counteract—and facilitating a company’s AI governance for hiring and other functions through explainable algorithms.

Why this matters: As ethical AI becomes more important to companies, Fiddler AI is enabling a wider range of players to monitor algorithms and avoid risks posed by AI bias and error.

Birdie

Birdie

Founders: Alex Hadade, Patrícia Osorio, Rodrigo Pantigas, Everton Cherman

Application: Insights

Headquarters: Palo Alto, California

Founded: 2018

Stage: Seed

Total funding: $8.6 million

Notable investors: SoftBank, Scale-Up Ventures, Illuminate Ventures, Fusion Fund, Endeavor Catalyst, Astella Investimentos

What it does: AI-enabled consumer analytics platform helps companies understand consumer opinion, identify opportunities in the market, prioritize relevant features, and define go-to-market strategies to build products with real-time AI-powered insights.

Why this matters: The platform helps marketers embrace AI to deepen their understanding of consumers and improve the consumer experience.

Funnelytics

Funnelytics

Founders: Mikael Dia

Application: Insights

Headquarters: Toronto

Founded: 2017

Stage: Seed

Total funding: $2.6 million

Notable investors: GreenSky Capital, MaRS Investment Accelerator Fund, Good News Ventures

What it does: Uses AI to collect customer data across platforms and extract insights about the customer journey and behavior. Applies data to map funnels and improve visibility for marketers.

Why this matters: The tool can help digital marketers map streamlined funnels and extract meaningful insights from customer data.

Placer.ai

Placer.ai

Founders: Noam Ben-Zvi, Ofir Lemel

Application: Insights

Headquarters: Los Altos, California

Founded: 2016

Stage: Series C

Total funding: $166 million

Notable investors: Spark Growth Ventures, MMC Technology Ventures, JBV Capital, Fifth Wall

What it does: Traffic analytics platform that generates location-based insights. Analytics platform converts foot-traffic data for retail properties into insights including visitation over time, trade area, brand, and demographics.

Why this matters: The tool can help retailers improve marketing efforts and long-term location planning.

Experience

Experience

Kore.ai

Kore.ai

Founders: Raj Koneru

Application: Experience

Headquarters: Orlando, Florida

Founded: 2014

Stage: Series C

Total funding: $73.5 million

Notable investors: Nvidia, Dallas Venture Capital, PNC, Vistara Growth

What it does: Offers an AI-native end-to-end contact center as a service (CCaaS) solution. Product enables companies to implement virtual assistants in a no-code context.

Why this matters: More companies can integrate conversational AI technologies regardless of tech talent.

Wispr AI

Wispr AI

Founders: Tanay Kothari, Sahaj Garg

Application: Experience

Headquarters: San Francisco

Founded: 2021

Stage: Seed

Total funding: $4.6 million

Notable investors: New Enterprise Associates, 8VC

What it does: Neural interfaces—direct communication pathways between the brain and external devices—for the mass consumer market. Built to interact with smart home devices like Alexa and apps like Spotify.

Why this matters: WISPR has the potential to change how people interact with apps and devices, expanding opportunities for players to reach consumers.

Jina AI

Jina AI

Founders: Dr. Han Xiao, He Xuanbin

Application: Experience

Headquarters: Berlin

Founded: 2020

Stage: Series A

Total funding: $37.5 million

Notable investors: Canaan Partners, Mango Capital, GGV Capital, SAP.io Yunqi Partners

What it does: Neural search, guided by a neural network rather than explicit rules. Applications for use cases as diverse as 3D assets for gaming content production, images on ecommerce sites, and a chatbot that understands hybrid queries.

Why this matters: The product has the potential to change the way companies interact with search, which is growing as a channel. The company is enabling more effective decision-making by developing search solutions to leverage actionable insights from unstructured data, such as conversations and pictures.

Ada

Ada

Founders: Mike Murchison, David Hariri

Application: Experience

Headquarters: Toronto

Founded: 2016

Stage: Series C

Total funding: $190.6 million

Notable investors: Version One Ventures, Spark Capital, Giant Ventures, Bessemer Venture Partners, Accel

What it does: Provides an automated customer experience solution with chatbots for customer support.

Why this matters: Streamlining and improving customer support processes create long-term value for brands. The product can help companies interact with customer issues more accurately and promptly.

Blueshift

Blueshift

Founders: Vijay Chittoor, Manyam Mallela, Mehul Shah

Application: Experience

Headquarters: San Francisco

Founded: 2014

Stage: Series C

Total funding: $64.6 million

Notable investors: Storm Ventures, SoftBank Ventures Asia, Nexus Venture Partners, Fort Ross Ventures, Conductive Ventures

What it does: Helps brands deliver relevant and connected experiences across customer interactions through an AI-powered platform. Connects data sources to delivery through a visual platform, enabling marketers to make better informed decisions.

Why this matters: Marketers can deliver personalized content at scale, build seamless omnichannel experiences, and unify customer data. The tool can help marketing teams improve targeting and allocate assets more intelligently.

OpenAI

OpenAI

Founders: Sam Altman, Elon Musk, Greg Brockman, Ilya Sutskever, Wojciech Zaremba, John Schulman

Application: Experience

Headquarters: San Francisco

Founded: 2015

Stage: Pre-seed and corporate round

Total funding: $1 billion

Notable investors: Y Combinator, Microsoft, Khosla Ventures

What it does: Advanced conversational AI language models with a unique API that can be applied to any language task, serving millions of production requests every day.

Why this matters: OpenAI is constantly improving the underlying language tech and enabling a wide variety of applications including customer service, content generation, and translation. Companies can use the API directly.

Automation

Automation

Tactic

Tactic

Founders: Rudy Lai, Jack Hodkinson

Application: Automation

Headquarters: London

Founded: 2020

Stage: Seed

Total funding: $4.5 million

Notable investors: Index Ventures, GTMfund, Visionaries Club, Foreword VC

What it does: Enables sales professionals to automate the outbound sales research process through data automation.

Why this matters: The tool saves companies’ business development representatives time on typical activities, like researching prospects, and more fully prepares teams for sales meetings using the AI research tool.

Standard AI

Standard AI

Founders: Jordan Fisher, Michael Suswal, Brandon Ogle, TJ Lutz, John Novak, David Valdman, Daniel Fischetti

Application: Automation

Headquarters: San Francisco

Founded: 2017

Stage: Series C

Total funding: $238.7 million

Notable investors: K3 Diversity Ventures, Y Combinator, Initialized Capital, EQT Ventures, CRV, Social Capital

What it does: Provides an autonomous checkout tool that can be installed into retailers’ existing stores. Recently acquired ThirdEye Labs, which developed an AI assistant to analyze CCTV streams and uses machine learning algorithms to detect retail theft in real time.

Why this matters: Companies can streamline checkouts and reduce theft in retail stores.

Bluecore

Bluecore

Founders: Mahmoud Arram, Fayez Mohamood, Max Bennett

Application: Automation

Headquarters: New York

Founded: 2013

Stage: Series E

Total funding: $238.2 million

Notable investors: Norwest Venture Partners, FirstMark, Georgian, Silver Lake Waterman

What it does: AI-driven retail marketing platform that uses predictive analytics to automatically connect shoppers to products, content, and offers. Its focus is to enable brands to take advantage of a digital-first commerce environment and to create long-term customers.

Why this matters: Retailers benefit from potential customers being automatically matched with products and offers they identify with. Marketers can use the tool to improve customer trust and engagement.

Experience

Experience

Narrativ

Narrativ

Founders: Li Haslett Chen

Application: New channels/interaction

Headquarters: New York

Founded: 2015

Stage: Seed

Total funding: $11 million

Notable investors: Act One Ventures, Winklevoss Capital, Talis Capital, New Enterprise Associates, Blue Collective

What it does: Subscription technology platform for brands to gain new customers through trusted creators, rather than through sponsored content or ads.

Why this matters: Using AI can help brands find new customers and creators to forge new brand partnerships. The technology has the potential to change the traditional marketing model.

Engaging with AI Startups Has Become a Competitive Imperative

As more companies begin to integrate AI into their solutions and products, brands that keep up with startup innovation will be ahead of the game. Specifically, brands should pay attention to startups that are solving long-term problems in customer experience, as well as those creating new capabilities that larger companies can incorporate, invest in, or monitor for future use.

The set of players that connect with startups will diversify as AI strategies become commonplace in all types of organizations.

![]() “Enterprises are starting to get smarter and more comfortable with the process of adopting startups,” said Index Ventures’ Price-Wright. “Since the start of the pandemic, procurement processes that would have been extremely arduous three or four years ago—and would’ve allowed only one or two startups to get through in a given year—are just moving way, way faster.”

“Enterprises are starting to get smarter and more comfortable with the process of adopting startups,” said Index Ventures’ Price-Wright. “Since the start of the pandemic, procurement processes that would have been extremely arduous three or four years ago—and would’ve allowed only one or two startups to get through in a given year—are just moving way, way faster.”

Opportunities for Brands to Connect with Startups

Opportunities for Brands to Connect with Startups

Engaging with startups is becoming a requirement for companies looking to be at the forefront of digital transformation in their industries. Here are a few potential avenues of engagement:

Build tech in-house without interacting with a startup. Companies can try to do it all themselves by hiring AI talent directly, or they can engage a traditional consulting firm like IBM or Accenture to build AI tech for their specific use case.

Act as a traditional customer to a startup. Brands can buy or license an AI software product. However, this usually results in the least customization for companies, unless they are an early customer. For example, Hitachi, Groupon, Royal Caribbean Cruises, and Xerox are all customers of Abnormal Security, which provides cloud email security.

Partner or launch a joint venture with a startup. A strategic partnership or formal joint venture can help brands get more access to a startup’s technology, specific use case functionality, and programs. Joint ventures are particularly useful for medium-sized companies that will benefit from outside help and perspective. For instance, Volkswagen Commercial Vehicles leans on Argo AI’s autonomous driving capabilities as the two companies work together to build a self-driving test vehicle.

Invest in a startup. Through either a corporate venture arm or more traditional corporate development activity, investment in a startup could potentially lead to a board seat, long-term involvement in company vision and strategy, and influence on major decisions. For example, New York Life Insurance, through its venture arm, invested in Data Robot and Cogito as part of its growing ecosystem of innovative tech companies impacting the industry.

Acquire a startup. If a brand believes the expertise and potential value of a startup are particularly promising, then a full acquisition is an option. It’s important to consider not only how the technology will help the brand, but also how the startup will align with the brand’s culture and long-term vision.

Companies are acquiring AI startups at an increasing rate to build out their AI practices. For example:

- Microsoft acquired Nuance in March 2022.

- Cision acquired Brandwatch in June 2021.

- Shutterstock acquired three AI companies in 2021 and launched an AI division.

- Big Tech companies like Google, Apple, and Amazon frequently acquire AI startups for talent-grab purposes.

How to Separate the Fool’s Gold From True AI Startup Value

How to Separate the Fool’s Gold From True AI Startup Value

More than 40% of over 2,800 self-identified AI startups in Europe aren’t actually using AI, according to a 2019 report by MMC Ventures. In reality, they may be using old-fashioned statistical approaches or a team of engineers to do the work. Please note that although this data was published in 2019, we include it because it paints an important picture of the risks, and it’s likely that the trend has worsened.

Investors should do their due diligence to pick out the true, successful AI startups from the ones selling hype.

Understand the type of ML data training, models, and platforms that startups are using. In choosing a startup, brands should also ask important questions about cloud technology use, associated costs, staff expertise, and more.

Be strategic and concise in deployment of AI. Successful brands understand that deploying a new AI product or use case takes time. Clear and simple projects—for example, a project focused on one problem within one function based on one dataset—are best because they can be managed well by all players. Successful deployment requires initiative from a cross-functional team that is comfortable engaging a third party in the event of knowledge gaps.

Weigh model sophistication versus project cost. Successful brands will not strive for sophistication at all costs. If a cheap and simple model fulfills 80% of customer needs and can be shipped within a couple of months, there’s no need to seek a more expensive model that goes beyond the specific use case.